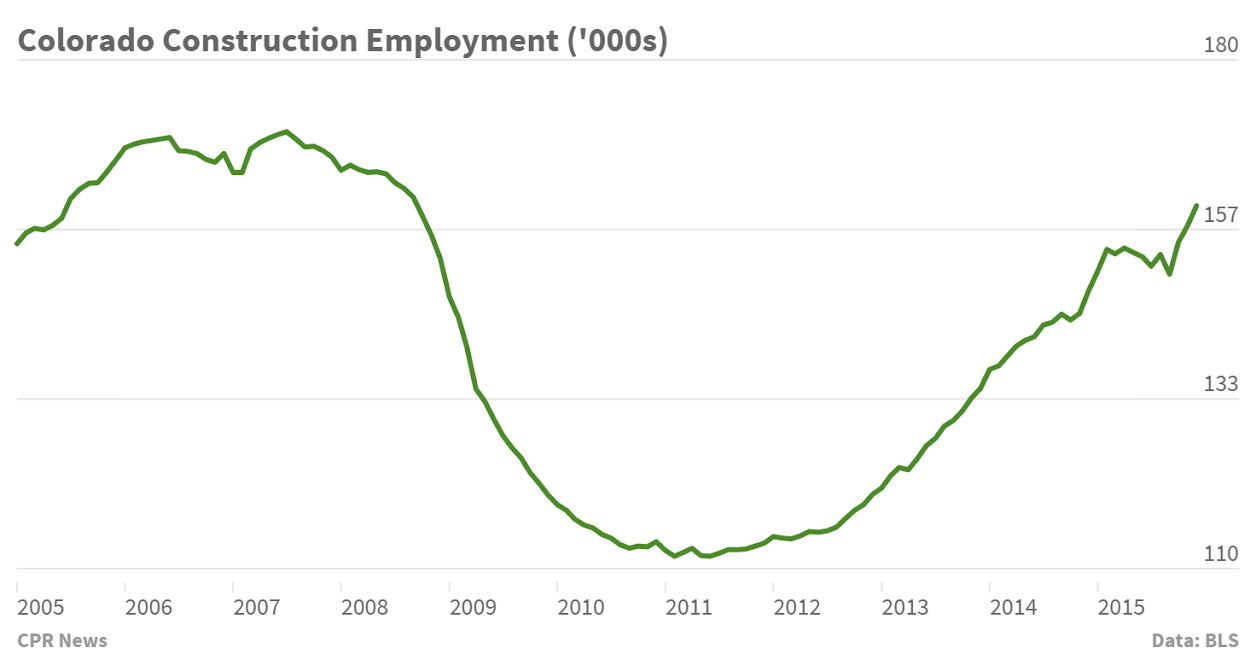

Colorado, at least along the Front Range, could be called the State of Construction. An unrivaled level of building is rapidly altering cities from Denver to Fort Collins, leading scores of workers back into the industry.

The Halcyon hotel under construction near Denver’s Cherry Creek shopping center is emblematic of these changes, wrapped in a plastic sheet like a massive Christmas present. Inside, it’s a hive of activity -- but not without a challenge.

Brad Booher, an assistant project manager for Mortenson Construction at the job site, says it’s not easy to put together a skilled crew when construction is going on seemingly everywhere.

“It has been a little struggle, but we’re playing through it,” says Booher, who got into construction just a few years ago, completely missing the downturn.

“I’m fine with that actually,” laughs Booher. “Perfect timing for me I guess.”

It really is. 2015 was a record year for construction in the Denver area, with $6.5 billion in new building, according to Dodge Data and Analytics. That was good enough to rank Denver 10th nationally.

Gene Hodge, an executive at Mortenson Construction, sits in a Lodo office in the heart of the downtown construction boom. But he says there's more to the boom than the city's core. There's cranes and job sites all over the Tech Center, the surrounding southern suburbs and up and down the Front Range.

"Hundreds of thousands of square feet of office building, a lot of apartments,” says Hodge. “There’s a lot going on up in Boulder right now. Fort Collins is a very interesting town, that place is booming for it’s size.”

It may seem like too much construction, especially when it comes to apartment buildings, he says. But he believes the looks are deceiving, considering Census data showing that Colorado grew by 100,000 people in just one year.

"When you think about 100,000 people coming here, it doesn’t seem totally insane that we’re building 6,000 to 10,000 new apartments every year," Hodge says.

"You know, 'bubble' is a very sensitive word to use if you’re an economist, because bubbles usually burst,” says Richard Branch, an economist with Dodge Data and Analytics.

But Branch isn’t expecting anything to burst, because, he says, fundamentals here are strong. Businesses absorbed 1.1 million square feet of office space in Denver last year, despite the oil bust, according to CBRE Group, a global real estate and investment company. And when it comes to apartments, 93.2 percent are filled, according to the Apartment Association of Metro Denver.

Branch predicts 2016 will be another big construction year for the Denver metro, but maybe not record setting.

“We may just see kind of a plateau, or kind of hanging out at this level for a little bit," he says.

One of the things that might keep Denver from overheating: lending from banks, according to Jay Despard, the managing director of the Denver office for Hines, one of the largest developers in the world

“For the first time in -- at least since I’ve been here, which is over 10 years downtown -- is you’re seeing more discipline. Banks are not lending on sort of these half-baked ideas.”

Hines itself is building a 40-story office tower downtown. But while Denver especially is on an epic run, but it can’t go on forever.

“At some point the music does stop,” Despard says. “I mean it’s been historically proven, time and again. This doesn’t go on forever.”

But he wouldn’t predict when that would happen.