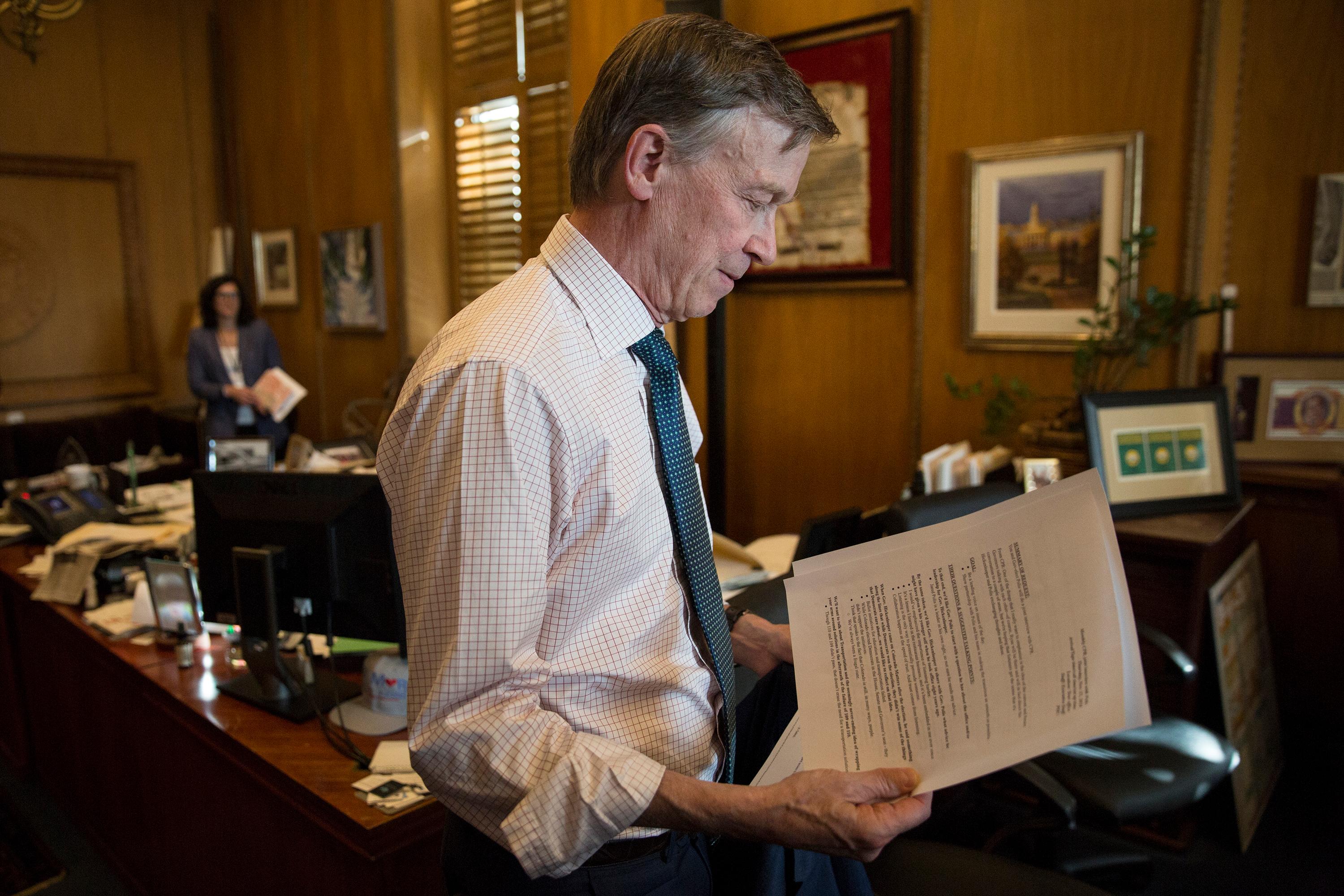

Gov. John Hickenlooper asked the state Supreme Court on Tuesday to clarify how two constitutional amendments — the Gallagher Amendment and the Taxpayer’s Bill of Rights — should jointly affect taxes.

The document submitted to the justices said the state is “facing a constitutional conflict” that is creating statewide impacts.

“Colorado’s local governments must be able to provide essential services,” Hickenlooper said in a released statement. “With clarification from the Colorado Supreme Court, we will be able to address the funding issues caused by the conflict and find a workable solution.”

Gallagher requires that residence owners pay 45 percent of all property taxes and that commercial property owners pay the rest. TABOR requires that tax increases be approved by voters affected by them.

The combined effects have reduced funding for some agencies, including rural libraries and fire departments. Hickenlooper calls it an "irreconcilable conflict."

If the justices agree to consider the questions, their answers could affect property tax bills.

The state constitution allows the governor to ask constitutional questions, but the court can turn down the request.