Amendment 69, which sought to create a first-in-the-nation statewide tax-funded universal health plan called ColoradoCare, was beaten decisively on Election Day. Another health-related ballot measure, which allows for terminally ill patients to end their own lives with the help of physicians, was approved by voters.

In the Denver metro, the SCFD cultural tax also won another lease on life.

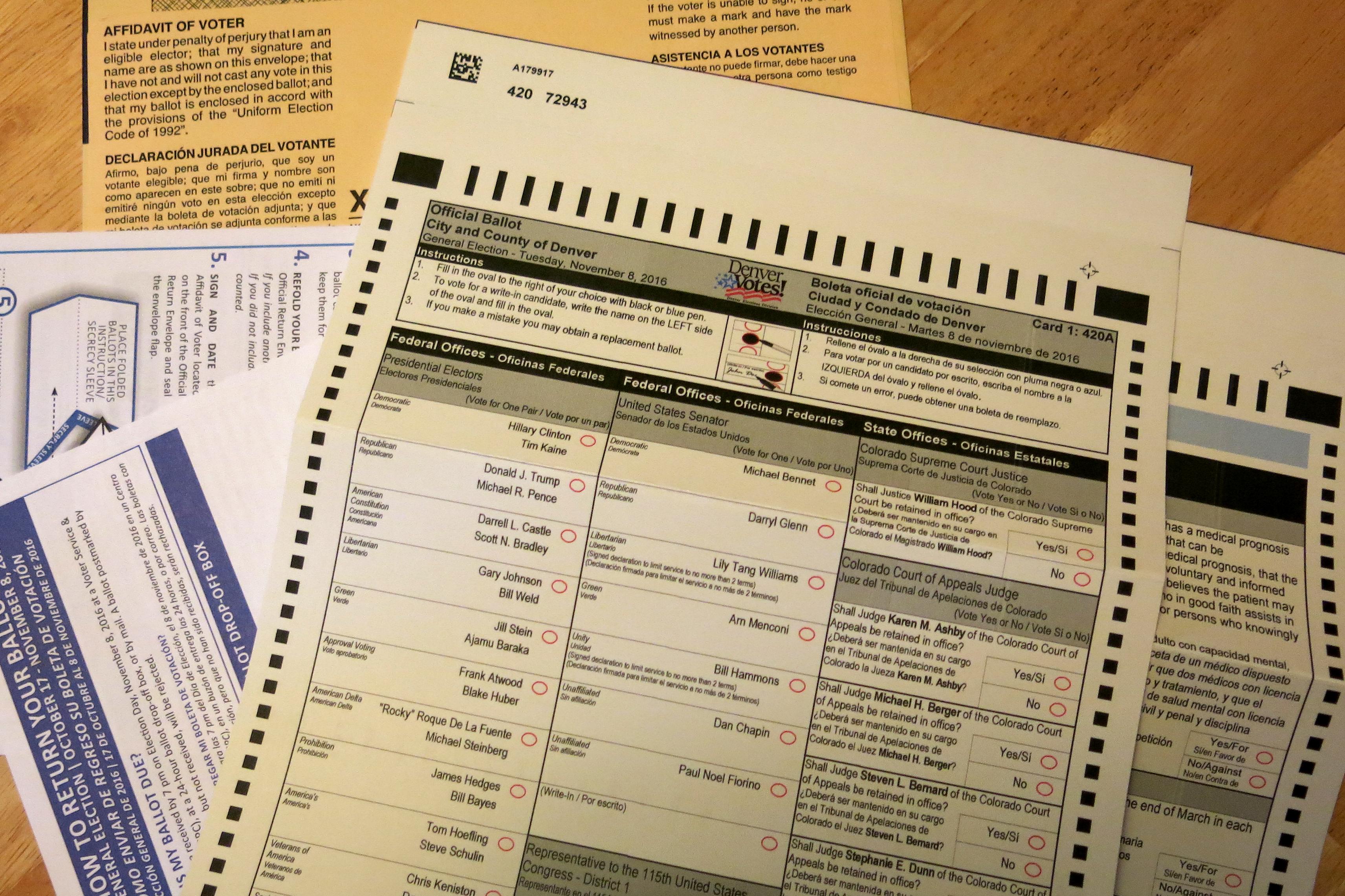

Those are just some of the ballot ballot measures that were put to voters. Here’s a look at how a number of those key statewide measures played out.

Rejected: Amendment 69, Statewide Health Care System

Had it passed, every resident would get health care insurance coverage that would take the place of most private insurance. Consumers would have made co-payments, but would no longer have premiums and deductibles.

To pay for the plan, there would have been a new 10 percent payroll tax, with your employer paying two thirds of that, with you paying the remaining third. The self-employed would have also paid 10 percent. Those taxes would have worked out to $25 billion in revenue for 2019, the program’s first year.

Kelly Brough, CEO of the Denver Metro Chamber of Commerce, which helped lead the charge against ColoradoCare, said the measure's cost was a key to its downfall.

ColoradoCare would have also administered the state’s Medicaid program, so its final budget was estimated to have been $36 billion -- bigger than the state government's budget.

T.R. Reid, who helped lead the ColoradoCare campaign, told a crowd of supporters they’ll go back to the drawing board and predicts they’ll try again.

“People who thought they were stuck with the insurance companies and stuck with our rotten healthcare system now realize there’s a way out, there’s a better way and we’ve shown it to them and we’re going to pass it this year or next," he said.

Approved: Proposition 106, Medical Aid In Dying

Proposition 106 calls for terminally ill patients to be able to take their own lives with medication prescribed by a physician. Colorado would be the sixth state where this is legal, joining Oregon, Washington, California, Montana and Vermont.

The measure is modeled after Oregon’s first-in-the-nation law and has several key components. You must be a resident of Colorado, an adult 18 or older, and determined by two doctors to be “mentally capable” of making health care decisions. You must be making the choice voluntarily and must self-administer the doctor-prescribed drug, generally a sleeping medication called secobarbital.

Proponents argued people should have the choice to end their lives as they choose, especially if they’re facing an agonizing, painful death. Opponents believe it’s morally wrong, saying doctors can make mistakes and that the measure won’t stop doctor shopping and won’t require a doctor to be present when a person dies. They also worry the measure would create a slippery slope potentially leading to euthanasia.

Approved: Proposition 107, Presidential Primaries

Proposition 107 will replace political party caucuses in favor of a state run presidential primary. It will also open that primary to unaffiliated voters. That means they'd be able to pick a presidential candidate for the general election even though they don't belong to a party.

The companion measure, Proposition 108, opens down-ballot primaries to unaffiliated voters as well. The AP has not yet called that contest.

The impetus for these ballot measures began in March 2016. An unexpectedly high number of voters turned out for the Democratic caucuses, driven in part by their zeal for Vermont Sen. Bernie Sanders’ campaign. When the dust settled — at some caucuses, voters had to be turned away because the facilities simply weren’t staffed and large enough — Sanders actually won more delegates, but Hillary Clinton had locked up pledged, or superdelegates.

On the Republican side, the party chose not to hold a presidential preference poll on caucus night. Later, at the party’s state assembly there was an uproar among supporters of Donald Trump because they were blindsided by a better organized Ted Cruz campaign. The Texas senator won the state’s GOP delegates handily.

Approved: Amendment 70, State Minimum Wage

Amendment 70 aims to raise Colorado's minimum wage for most workers from its current level of $8.31 an hour to $12 an hour by 2020. Wages for tipped employees would increase from $5.29 per hour now to $8.98 per hour in 2020.

Colorado's minimum wage already adjusts annually based on the Denver-Boulder-Greeley Consumer Price Index, and those adjustments would continue from 2021 onward. However, Amendment 70 would prevent the minimum wage from decreasing during times of deflation, something which occurred in 2010, when the wage declined four cents.

Under current Colorado state law, local governments are not allowed to set a minimum wage different from the state's, and that prohibition would continue under Amendment 70.

Approved: Amendment 71, Constitutional Amendments

Amendment 71 will make it harder for citizen-backed state constitutional amendments to get on Election Day ballots. Supporters say amending one of Colorado’s foundational documents should be harder than it is and that state lawmakers should be more willing to legislate on issues that often get pushed to ballot questions. Opponents say ballot questions are democracy working in one of its purest forms and that making it harder to get on the ballot flies in the face of citizens exercising their rights.

Approved: Ballot Issue 4B, The SCFD Cultural Tax

Voters first passed SCFD in 1988, and then extensions again in 1994 and 2004. It creates a penny per $10 sales tax in the metro Denver area. Since its inception, it has raised more than $910 million.

The renewal also brings a change to the way funds get distributed. Starting in summer 2018, a bit more money will go to small and mid-sized organizations. Some arts leaders have said the new formula doesn’t go far enough. In response, the SCFD board plans to create grants specifically aimed at groups that serve diverse communities.

"There’s clearly more money going to be available. We’ll reach out to these groups and bring them into the fold," SCFD board chair Dan Hopkins said on election night.

Roughly $54 million was distributed in 2015 to more than 270 arts organizations in the district both large and small. Each organization that qualifies for eligibility must go through an application process to get SCFD funding.

Voter approval this time around means the cultural tax continues through 2030, when it will again come up for renewal. In addition to keeping the tax, this year’s measure changes how much money goes to each of three tiers funneling a bit more money to small and mid-sized groups starting in 2018.

In Larimer County, voters said “no” to creating a similar cultural tax district of their own.

“I feel disappointed, I feel like the county has not been forward-thinking,” said Bruce Freestone, co-founder of OpenStage Theatre in Fort Collins, who helped organize the effort around Initiative 200. “In the circle that I work in, everybody was very much in favor. So I was very optimistic, but I think, obviously, I was preaching to the choir.”

Rejected: Amendment 72, Tobacco Tax

The tobacco tax hike failed by 53 percent to 47 percent. Championed by public health and children’s advocates who argued that research shows a higher tax would discourage smoking, Amendment 72 would have more than tripled the tax on a pack of cigarettes, from 84 cents a pack to $2.59. Taxes on other tobacco products would have also risen, by 22 percent.

Opponents spent millions on ads painting it as a blank check. It would have raised $315 million in its first year, paying for a variety of programs, including money for medical research into cancer prevention ($92 million), smoking prevention ($54 million), medical and health for 500,000 veterans ($48 million), and healthcare in rural and underserved areas ($34 million).

Tens of millions of dollars would have gone to youth behavioral health services, student debt repayment for medical professionals serving rural and underserved areas and to current tobacco tax funded programs to make up for lost revenue due to lower tobacco use once the new tax is in place.

The tobacco giant Altria sunk a near record $17.5 million into killing the proposal -- more than seven times the amount of money backers raised. Early polls showed the tobacco tax seemed to have a decent chance of passage, but the spending and ads seemed to be decisive.

Rejected: Question 200, Pueblo Pot Ban

In Question 200, voters opted not to shut down retail marijuana stores, grow operations and related businesses. At same time, a number of cities chose to make pot legal.

Ordinance 300 in Denver asked voters to approve a city and county measure that would open just about any business in Denver to marijuana consumption. The results there were still close to call Wednesday afternoon.

Rejected: Amendment T, No Exception To Slavery Prohibition

Article II, Section 26 of the Colorado Constitution says, “There shall never be in this state either slavery or involuntary servitude, except as a punishment for crime, whereof the party shall have been duly convicted.”

Supporters of the measure say that “it represents a time in the United States when not all people were seen as human beings or treated with dignity. Removing the language reflects fundamental values of freedom and equality, and makes an important symbolic statement.”

Opponents say that it “may result in legal uncertainty around current offender work practices in the state. Prison work requirements provide structure and purpose for offenders, while enabling skill building and helping to reduce recidivism. … Such practices have a place in the correctional system.”

Will Dickerson, with Together Colorado, a nonprofit that lead the charge on the Yes on T campaign, said the language on the ballot might have confused voters. The amendment failed by less than 2 percent.

Rejected: Amendment U, Property Taxes

This was a ballot measure with some complicated wording: “Beginning with tax year 2018, eliminate property taxes for individuals or businesses that use government-owned property for a private benefit worth $6,000 or less in market value; and beginning with tax year 2019, and every two years thereafter, adjust the $6,000 exemption threshold to account for inflation.”

Translation, according to the ballot language: “Amendment U reduces the administrative burden of collecting a tax that in many cases costs more to collect than it brings in to local governments.” Opponents said it “creates an unfair tax break for businesses and individuals who use government-owned land.”

Mixed Results: Statewide Education Funding Ballot Measures

There were about 62 different measures spread across 44 school districts, according to the Colorado School Finance Project. About two-thirds of those passed.