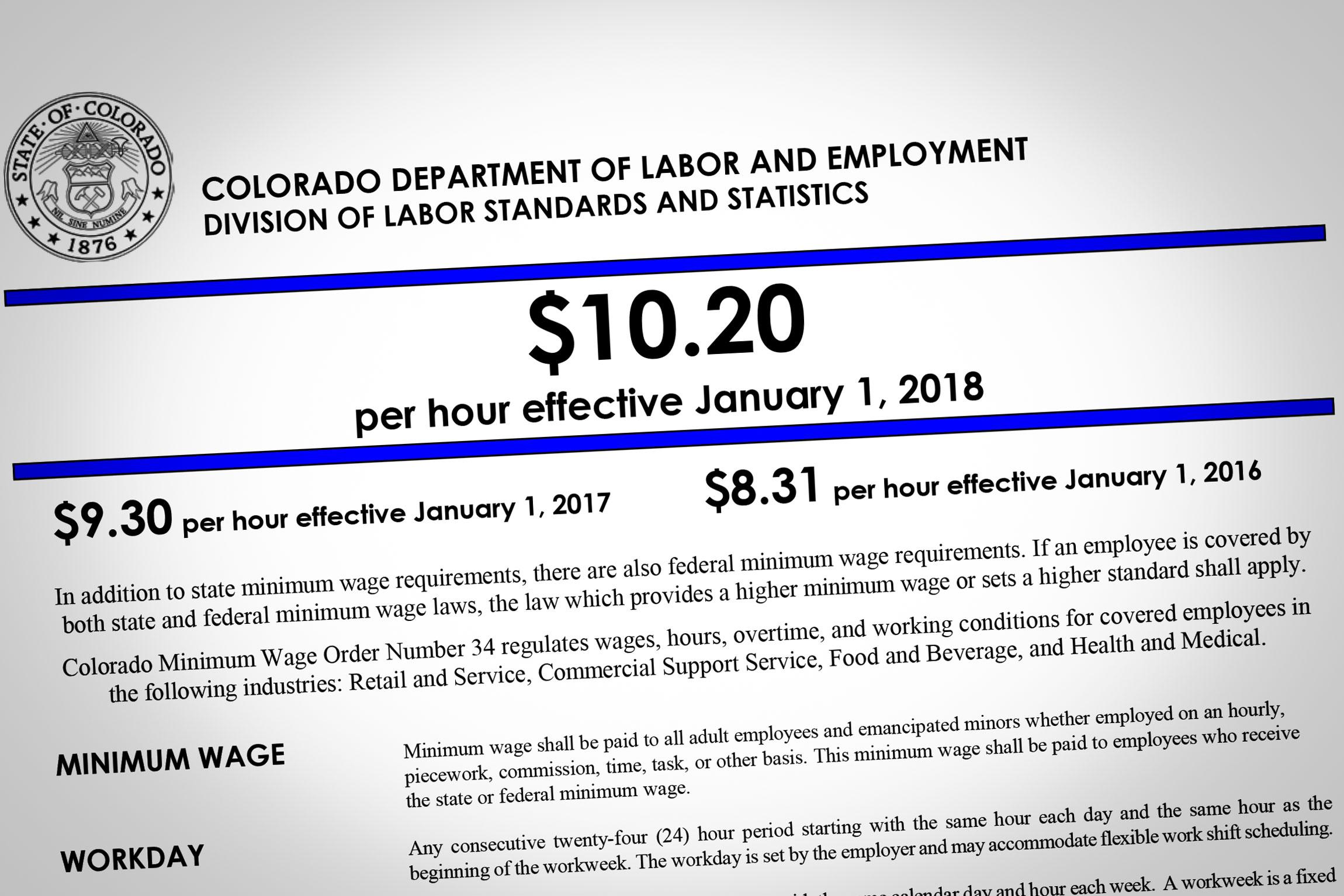

Colorado’s minimum wage went up by 90 cents on New Year’s Day, lifting the state’s base hourly pay rate to $10.20. This is the second year in a row with a higher minimum wage, the result of 2016’s voter-approved Amendment 70.

Two more increases are expected, in 2019 and again in 2020, until the minimum wage reaches $12/hr.

That’s a boost for workers, but it puts some nonprofit agencies like Community Options, based in Montrose, in a bind. Paying their workers more is straining their budget.

The organization serves people with developmental disabilities and is funded through Medicaid. It’s not keeping up with what it now has to pay its employees.

“We’re rapidly depleting our fund balance which we have built up over 45 years,” said Tom Turner, the executive director of Community Options. “And we’re also making a lot of programmatic changes. We’ve closed one of our group homes. We’ve closed some other residential settings to try and deal with this.”

The first minimum wage increase cost Community Options about $120,000. Turner said the organization spent 2017 trying to handle the expense, and that it’s going to be harder in the New Year. They haven’t had to cut staff yet though because they are already “are so bare-boned staffed to begin with.”

“First of all, there are a number of requirements in terms of staffing ratios in our facilities, etc., and we’re pretty much at the bare minimum of that to begin with so to start cutting back on staff who are taking care of people with significant disabilities, number one, morally, we certainly don’t want to do and from a regulatory standpoint we don’t have the ability to do,” he said.

Conversation Highlights With Tom Turner

On how the minimum wage increase affects both employees and employer:

“We have a number of employees who currently qualify for Medicaid that we know are going to lose their Medicaid eligibility when they get this raise. If so, they will be coming to our agency looking for health insurance, which costs the agency another $8,000 a year. So even if it’s ten employees who that happens with, that’s another $80,000 a year on top of the other increases that we’re facing.”

On what the increase means outside of retail:

“This trajectory is not sustainable. Absolutely. Amendment 70, philosophically, is a very nice thing, but for nonprofits, school districts, etc., that don’t have a product to sell or prices that they can raise to increase revenue, it’s a pretty scary scenario.”

On lobbying the state to increase Medicaid dollars:

“There are 20 agencies like Community Options around the state and we’re all kind of in the same boat. In the governor’s budget request, they have proposed a 0.77 percent Medicaid rate increase, which we have calculated will amount to about $52,000. So that certainly doesn’t come anywhere close to covering the amounts that we’re looking at.”

On a tax dollars solution:

“We do not have a local mill levy. We are considering the possibility of running one so this would be us having to mount a campaign to see if local property owners would be willing to increase their property taxes. But I think, as you know, anything relative to tax increases is not an easy sell and particularly not an easy sell in very conservative areas in Southwestern Colorado. So we are looking at other ways to increase revenue but don’t have those answers yet.”