The uptown neighborhood, near downtown Denver, is the city’s epicenter of apartment construction. More than 1,500 units are under construction or are just completed.

The hulking Radius Uptown tower is one of those freshly constructed apartments.

It’s a nice place, replete with high end finishes and a view. It’s close to restaurants. Yet, it’s still surprising to hear that such a new building is already more than 90 percent full.

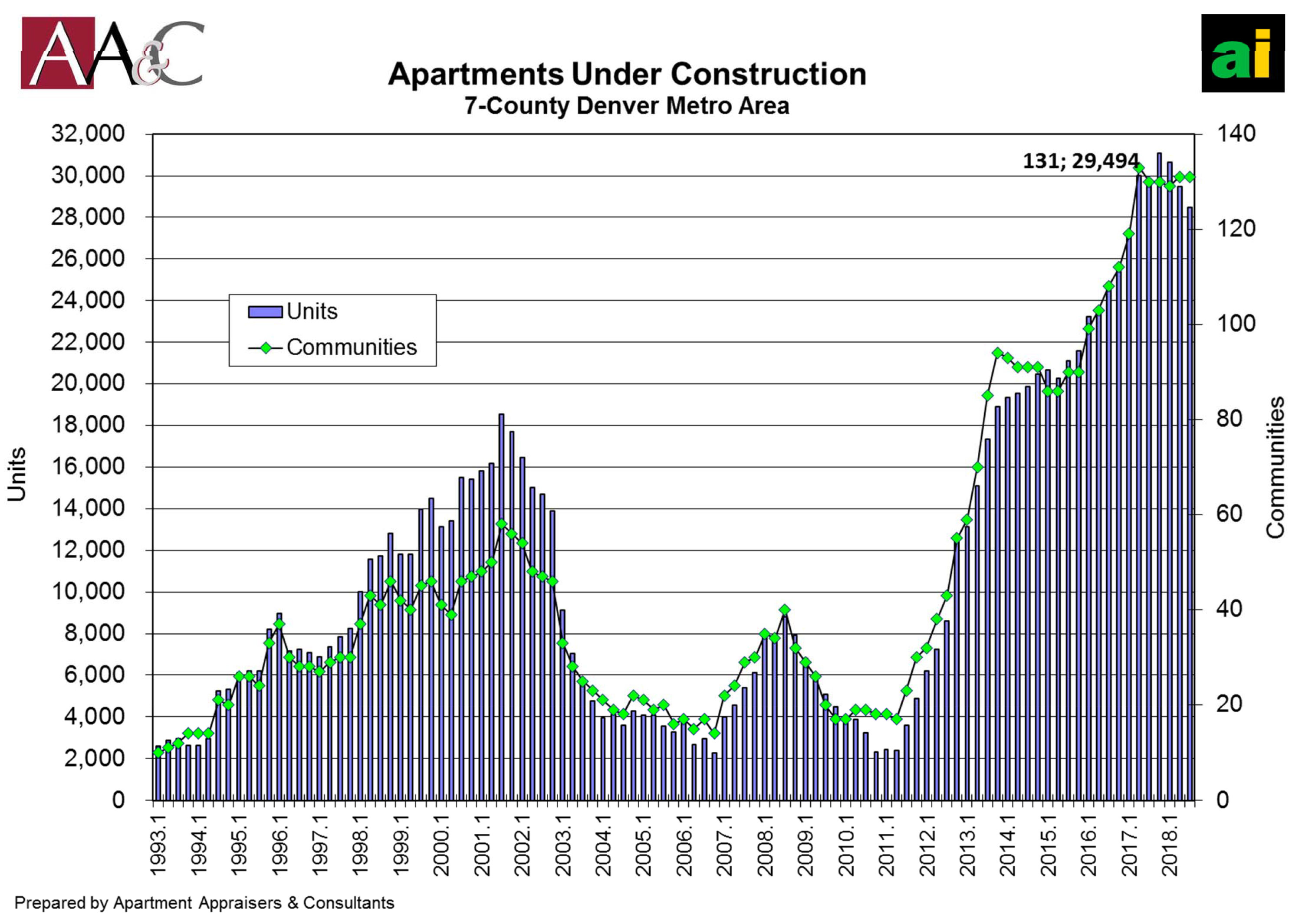

There’s a perception in Denver right now that suggests the market is saturated, especially given the construction boom. Builders finished more than 10,000 apartment units in the Denver area in 2017, with another 30,000 under construction. It’s an unusual volume of building that’s increased the competition for renters.

With the Radius, rent concessions have helped fill the building.

BJ Mathews, the new leasing agent for the complex (she just moved in herself), pointed out they’re offering 1 month free rent if you sign a lease this month — “and then we’ll throw in 6 months free parking.”

Concessions for apartments are up sharply, the Apartment Association of Metro Denver says it has jumped 41 percent over 2017. It’s a prime indicator of just how intense the competition is for renters.

“Here in Denver, we seem to hear a lot, that there’s a shocking amount under construction, but the numbers don’t necessarily agree,” said Matt Vance, an economist for real estate and investment firm CBRE.

Downtown Denver is probably underbuilt for apartments, Vance said, especially compared to similar cities. His predictor of apartment demand is a ratio of jobs per apartment, and Downtown Denver reached 6.6 jobs per unit at the end of 2017. Seattle has between 4 and 4.5 jobs per unit, which Vance said is a healthier ratio because developers have kept pace with job growth.

Denver continues to create lots of new jobs and people are moving into the state to fill them. Most new arrivals tend to be young apartment dwellers and the construction industry is happy to keep building to accommodate them.

“As companies continue to find themselves attracted to Denver and bring jobs here, we should see a healthy enough demand side to keep everything in check and to remain, you know, overall pretty healthy,” Vance said. “There’s no forecast for a dramatic correction.”

National economists believe a recession could hit in 2020, but downturns are hard to predict.

Cary Bruteig, with Apartment Appraisers & Consultants, has been in the apartment industry since the 80’s. He sees an unprecedented level of apartment construction, far beyond the previous peak in the late 90’s. Units are now filling at some of the highest rates he’s ever seen.

“More than double our long term average, and this is at rent levels that are at record highs for Denver,” Bruteig said.

Average rents in the Denver area have grown to $1,500 a month. Downtown averages $2,000 a month. Yet, many of these apartment dwellers are early in their careers. Now half of Denver renters are considered “rent burdened,” meaning regardless of income they spend more than 30 percent of their paycheck on housing.

Still, Bruteig thinks the apartment construction in Denver makes sense, to a point.

“I think that there is room to grow, my concern is that we are adding so many much product so quickly downtown, it’s at a very fast pace,” he said.

History has shown that recessions hit apartments hard. People stop filling units immediately. Vacancy spikes and rents fall. This could be a disaster scenario especially now, since Denver developers are building tens of thousands of units.

It’s not a problem at the moment and that brings us back to the Radius Uptown apartment building. BJ Mathews jumped at the chance to relocate from California and she’s not alone.

“So, we’ve been getting people from Chicago, Connecticut, Washington DC, so a lot of transplants out here,” Mathews said.

That influx of new blood into Colorado has been filling jobs and apartments at rates the region has rarely seen. As long as that lasts, all of the construction makes sense.