State leaders say consumers will see lower health care premiums, under a proposed partnership to develop a public health insurance option. But they’ll have to convince the state’s powerful hospital association, which opposes the plan.

Leaders of a pair of state agencies, the Division of Insurance and the Department of Health Care Policy and Financing, released their final report Friday for Colorado's public option.

What’s a bit confusing is the proposed plan is not so much a government-operated public option that’s been part of the national health reform discussion for years. The report recommends it be “structured as a public-private partnership,” administered by carriers but overseen by the state. Carriers would administer health plans, “hold the financial risk and financial reserves,” and contract with providers of care.

State insurance commissioner Michael Conway said the ambitious plan would make healthcare more affordable, with little impact on the state budget.

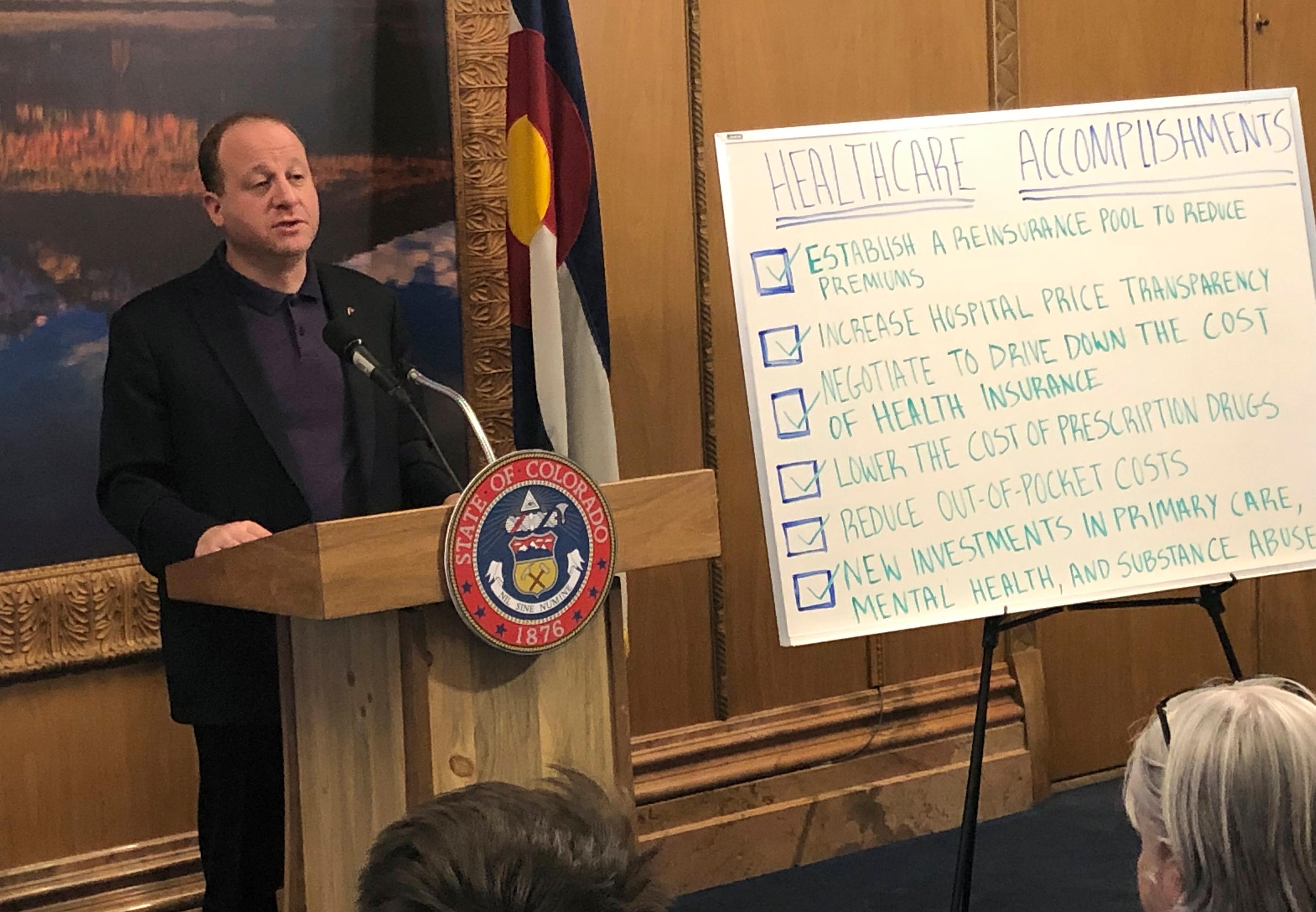

"More competition means more choices means more carriers," Conway said. “All of those things are transformative.” The plan is a key element in health reform efforts by the Polis administration and state lawmakers to try to help lower health costs and improve health access for consumers.

The plan is initially designed for individuals buying their own health insurance, several hundred thousand people, roughly 7 percent of the state’s population. Within two or three years, Conway said, it would expand to small and mid-sized businesses with less than 100 employees.

Customers will save a projected 10 percent on average on premiums, according to the report. High-cost areas of the state could expect higher savings: 17 percent on the Eastern Plains and 15 percent on the Western Slope.

The state's hospital association criticized it, saying it “continues to miss the mark” and is currently "unacceptable."

Julie Lonborg, vice president of communications with the Colorado Hospital Association, said in a statement that the proposal would establish government price controls and forces insurers and hospitals to participate. That “has the potential to undermine other affordability efforts underway,” she said.

Kim Bimestefer, executive director of the Department of Health Care Policy and Financing, thinks most hospitals like it. She said a minority are “battling this. We're encouraging that minority to be collaborative, to work with us and to help us find a way to be part of the affordability solution and that's exciting."

The report states the plan “will not put the state budget at risk,” that insurance companies not the state, will bear the risk for the payment of health claims, as they do now in the individual market. The proposal would cost the state about $750,000 to launch over two fiscal years, then less than $1 million a year for agencies to oversee and manage.

The state will set parameters, including reimbursement rates for providers. One aim is to allow “profitable delivery of services, while reigning in exorbitant rates.” The report states a special focus would be to “ensure rural, critical access and urban independent hospital sustainability.”

Colorado Consumer Health Initiative, which represents patients, said the proposal would protect those who use the healthcare system. Hospitals, insurers, and pharmaceutical companies will be held to “higher accountability and cost standards,” said Adam Fox, director of strategic engagement for the Colorado Consumer Health Initiative. He called it “a starting point to control the profit-taking and excess revenues” the healthcare industry now “squeezes” from consumers.

The Colorado Community Health Network, which represents community health centers, applauded the report, saying it “takes an innovative approach to moving the state forward” toward reducing health care costs and incentivizing the “right care in the right place.”

Public options plans would be sold through the state’s health insurance exchange, Connect for Health Colorado, and in the traditional, off-exchange individual market.

“We are eager to expand access to meaningful, high-value plan choice,” Connect for Health wrote in a statement.

State taxpayers would not fund the plans, according to the report. They’d be fully insured and offered by private carriers. The report recommends the state apply for a federal waiver. If approved by the feds, Colorado would use that money, nearly $90 million, to make the plans more affordable for consumers.

Every carrier, but not all, would have to offer the option to “spread both the opportunity and the risk.” The insurance commissioner would work with them to insure at least two carriers in each county. The report recommends the commissioner have authority to “mandate carrier participation” in counties with just one carrier. The Colorado Association of Health Plans did not respond to a request for comment before deadline.

An advisory board would provide input on the development and implementation of the proposal.

Key parts need approval from lawmakers. It would be available for coverage starting in 2022.

Editor's Note: This story has been updated to reflect that the report recommends the state apply for a federal waiver.