The original projection for 2020 was that Colorado’s job growth would continue, albeit at a slower rate. COVID-19 may alter that prediction.

“This is definitely a very severe impact to the economy,” said Ryan Gedney, a senior economist at the Colorado Department of Labor and Employment, of the novel coronavirus.

Colorado’s unemployment rate remained unchanged in January at 2.5 percent and employers added about 900 private sector payroll jobs and 400 government jobs. However, it looks like the projection is beginning to come true with growth slowing and landing at about 2 percent. January’s numbers indicate the state is seventh in the nation for job growth.

The largest job gains between December and January were in construction and professional and business services. This is consistent with trends over the past year. Trade, transportation, utilities and health services declined over a month. Mining and logging, which includes oil and gas workers, declined over the past year.

Brian Lewandowski, an economist with the University of Colorado Boulder, said it’s not surprising that coronavirus concerns have not been reflected in reports. He doesn’t expect numbers to reflect the influence of the pandemic till the March numbers come out in April.

“We’re still a top growth state nationally but this is all pre-coronavirus as far as impacts in the U.S.,” Lewandowski said. “We’re not really picking up any of those negative impacts from the coronavirus yet.”

He expects job growth to deteriorate to an extent over the next few months.

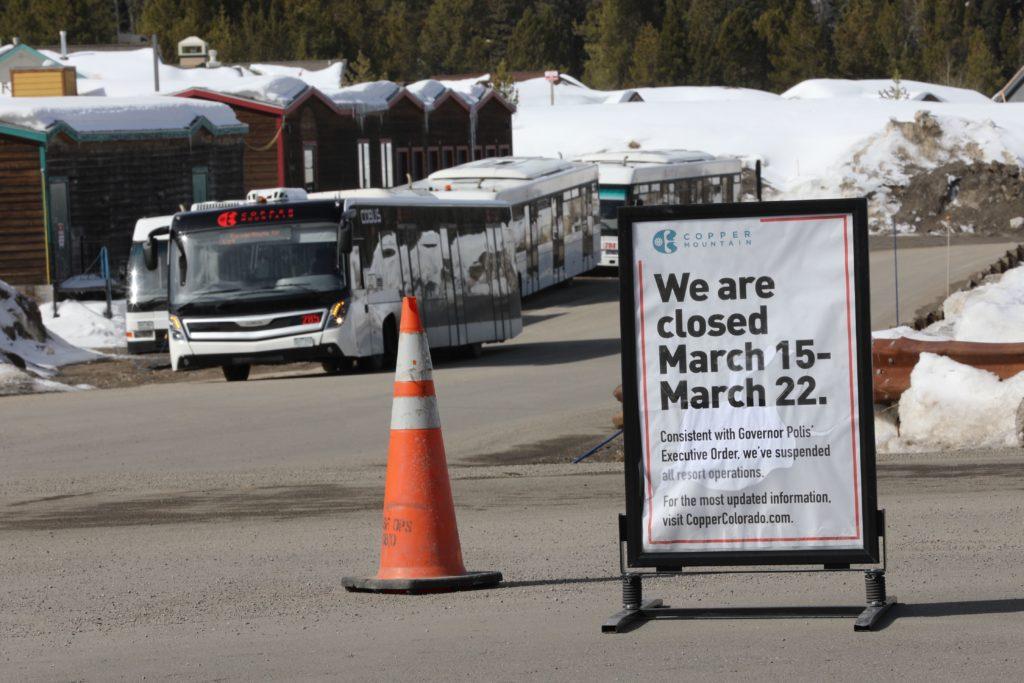

“Some of the negative impacts will start to show up in our restaurants, hotels and our tourism industries like our ski resorts,” he said.

Gov. Jared Polis issued an executive order to shut down all ski resorts Sunday. Denver Mayor Michael Hancock ordered Monday that all restaurants and bars will close on-site seating till May 11 — though delivery, drive-thru and carry-out will continue.

Although those sectors are likely to be the most vulnerable, Lewandowski said the pandemic will also probably affect manufacturers on the supply-side because of the disruption of imports.

“Colorado’s manufacturing is more resilient than national manufacturing because we have a lot of food, beverage and high-tech manufacturing which is less exposed than auto manufacturing,” he noted.

Ultimately, this may lead to a looming recession.

The economic growth estimates that economists look at on a national level point to negative Gross Domestic Product growth in the second quarter of this year. Although that alone does not indicate a recession, two slow quarters usually point to that. It’s not causation but typically a correlation.

Lewandowski said jobless claims might see an uptick within a few weeks. It will likely not be for another two months that an economic impact will be reflected in the report numbers.

“We’re seeing how this is impacting more and more industries as people are working from home, as public gatherings are shut down, [and] our schools,” he said.

Most of Colorado’s economy is service driven so many are able to work from home, though Gedney, the state economist, said that doesn’t apply to everyone.

“Individuals who work in retail or health services, they may not have the option to work from home,” he said. “It’s not feasible so that’s my main concern.”