Thousands of recipients of unemployment benefits may be off the hook for accidental overpayments they received in Colorado.

According to the state labor department, it overpaid about $1.4 million to 9,000 people through the Pandemic Unemployment Assistance program because of mistakes on applications. Many of those people were gig workers, and the error appeared to be rooted in a misunderstanding that led them to overstate their eligible earnings.

“When we looked into monetary eligibility for these claims, it did appear there was confusion,” said Cher Roybal Haavind, deputy executive director for the Colorado Department of Labor and Employment.

The state will freeze its efforts to reclaim those overpaid funds. It will immediately stop withholding funds from affected people. And the department plans to wipe away the remaining overpayment debts for this group late in October.

But people who have already repaid the money — including those who had funds withheld from their benefits payments — must appeal their cases to recover funds.

Labor officials began to notify people of the overpayments in July, creating widespread alarm among recipients who in some cases were told that they would have to repay thousands of dollars.

The most common cause was that people reported the wrong type of financial figures. Unemployment benefits for gig workers and independent contractors are supposed to be based on profits or losses — the amount they took home after expenses. Instead, many people reported their total earnings, which is usually a higher number.

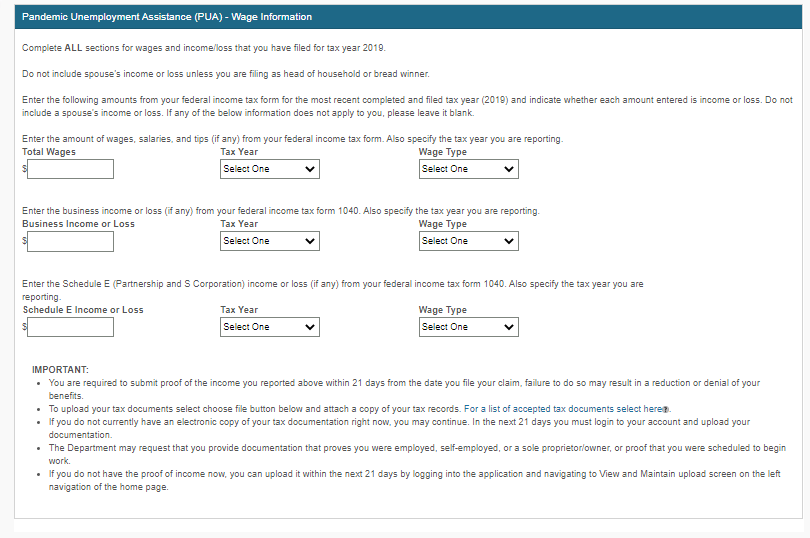

The forms used on the state’s website left room for error. They asked applicants to detail their “business income or loss.” It didn’t specify whether it was referring to “gross income” — earnings before expenses — or “net income,” which is earnings after expenses.

About 7 percent of Pandemic Unemployment Assistance applications were affected, according to labor department officials. The average person in that group was overpaid by roughly $150, but some cases went much higher.

“That is a very, very small percent of the total amount of money that we’ve paid out in PUA to date,” said Jeff Fitzgerald, the unemployment division director.

But Fitzgerald acknowledged that the financial impact could be significant and frightening for individuals.

Labor officials began to look into the confusion about three weeks ago and now plan to amend the form.

“Right now, we are working on amending the form with definitions to make the fields more clear,” Haavind said.

It’s unclear exactly who wrote the confusing language. Haavind said that the forms “mimic” another federal program, Disaster Unemployment Assistance. Fitzgerald said the forms were “leveraged” from the federal program.

But other states have used different language for their PUA applications. For example, Arizona’s PUA forms refer specifically to “net earnings.” Haavind said she would look into the source of the Colorado language.

She and other labor officials pointed out that the error was most common among gig workers, who may not be as familiar with business financial reporting as other independent workers. And they said that the vast majority of people appeared to navigate the process correctly.

“I can say that we share responsibility,” Fitzgerald wrote in an email. “We certainly could have amended language at the beginning. We were doing our best to get the PUA system up and running to serve this population. "

PUA is a new federal program created by Congress in response to the coronavirus pandemic. It has suffered from technological hiccups and apparently unforeseen problems in states across the nation, including a rule that has inadvertently penalized certain self-employed people gig workers.

Colorado and other states’ labor departments have been scrambling to pay out record-breaking volumes of unemployment benefits. They’ve also had to continuously update their systems to keep pace with changes instituted by Congress and, more recently, President Donald Trump.

“There is unprecedented demand for benefits and assistance, and with that comes direction to quickly administer those benefits,” Haavind said on Monday.

Colorado’s state government will not be responsible for the overpaid money. The PUA program is funded by the federal government.

The overpayment errors only began to surface in recent months. That's because the state’s initial focus was on getting payments moving amid an economic calamity, and it later spun up its enforcement efforts. By the time the errors were caught, some people had been overpaid for months.

The erroneous applications pale in comparison to another problem: fraud. Colorado labor department officials estimated that $40 million in overpayments were a result of fraud.

Have you been asked to repay unemployment benefits in Colorado? Contact the reporter.