Colorado officials estimate that they’ve shut down more than one million attempts to defraud the unemployment system, part of a national phenomenon of scammers using stolen identities to extract millions of dollars in benefits from the government.

So far, the perpetrators of these sprawling scams have remained largely anonymous and unpunished. There have been no widely reported cases of authorities in Colorado arresting anyone in connection to the reportedly widespread crime. But the state's top law-enforcement official hope to change that with a wide-ranging new effort.

“The amount of fraud that we’ve seen around this unemployment insurance is staggering,” said Attorney General Phil Weiser. “We want to hold people accountable. And to do so, we need a team.”

Weiser announced Thursday that the AG’s office will work with the Colorado Bureau of Investigation, the Colorado Department of Labor and Employment and district attorneys around the state to investigate the fraud attempts that have plagued the unemployment system

In September, the U.S. Department of Labor warned states about “criminal enterprises and other bad actors deploying advanced technologies, stolen or synthetic identities, and other sophisticated tactics,” according to a memo obtained by CPR News through a public records request.

Since then, the state has flagged hundreds of thousands of accounts as potentially fraudulent, a dragnet that has inevitably snared numerous legitimate applicants too, leaving unemployed Coloradans as collateral damage in the fraud fight.

Weiser said that prosecution wouldn’t stop fraud, but it could deter it.

“If there are individuals in Colorado participating in these schemes, picking up these unemployment cards and checks, or otherwise trying to cash in illegally, we’re going to do our best to find them and prosecute them,” Weiser said.

The AG’s office is accepting tips about unemployment fraud at stopfraudcolorado.gov, and victims of unemployment fraud may report it to the labor department.

Stolen information fuels fraud

In perhaps the most common scam, attackers use stolen personal information — such as other people’s birthdates and social security numbers — to fill out applications for unemployment benefits. If they succeed, the state pays out unemployment benefits to the scammer’s account. It can add up to thousands of dollars per month for each fake claim.

“The bad news for all of us is, the cat is out of the bag. Information about all of us is out there. It can and it will be used against us,” Weiser said.

Pandemic-inspired identity fraud is “perhaps the most pervasive and glaring example we’ve had. It will not be the last,” he added.

Until now, the state has largely played defense against unemployment fraud. For example, the labor department has expanded its use of automated software that flags suspected fraudulent claims.

Weiser said that the investigatory task force was assembling now because unemployment fraud continues to rise, and the expected extension of unemployment benefits this month will offer another opportunity for scammers.

From “fall into January, this was a rising problem,” Weiser said. “We’ve been building up this coordination and making sure that we have all the right networks in place.”

Who's doing it?

The U.S. DOL memo described schemes carried out by “complex, multi-state networks that necessitate a coordinated national response.”

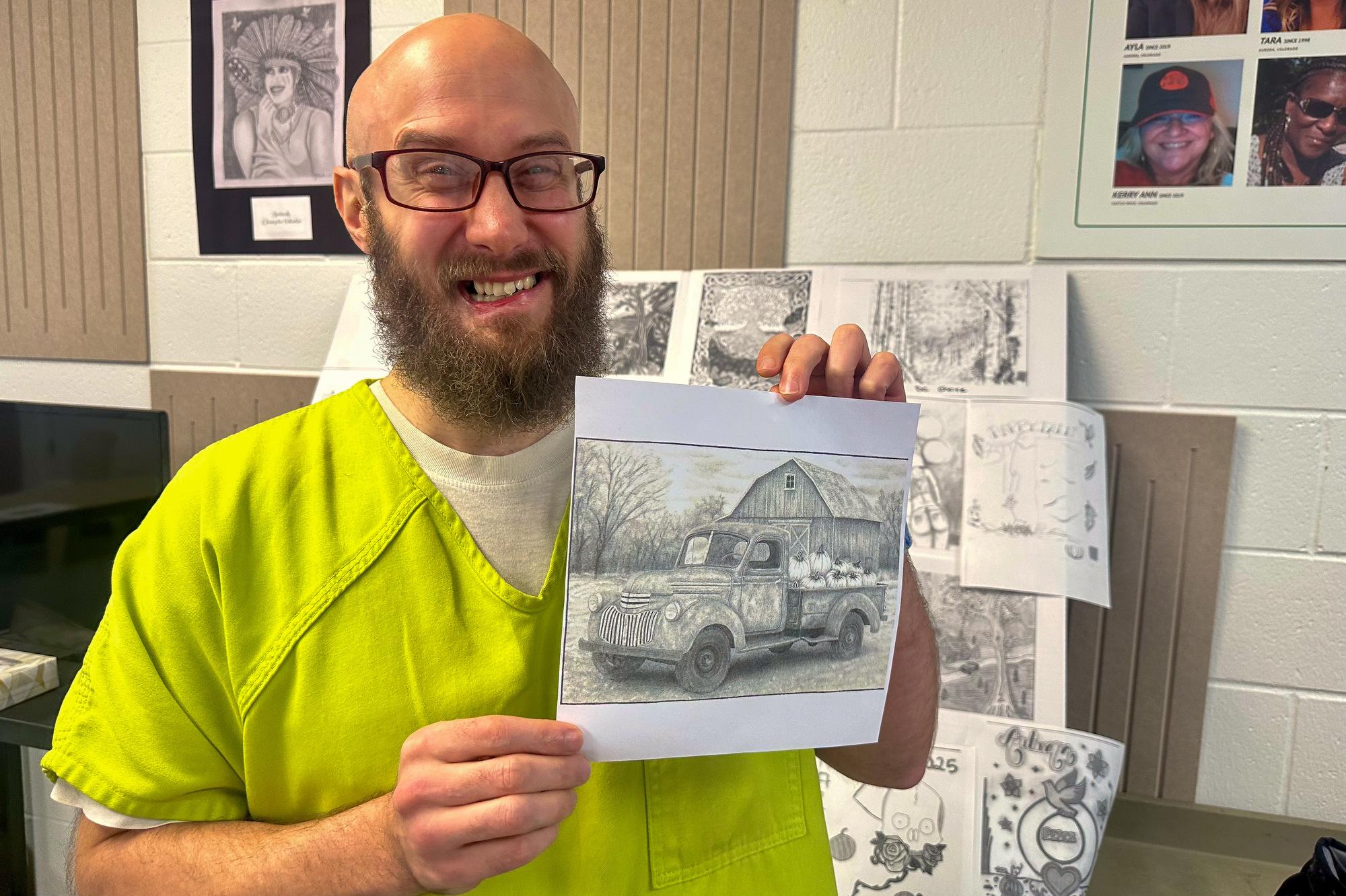

But sometimes the alleged perpetrators are working on a smaller scale. In California, a rapper who goes by the name Nuke Bizzle was arrested and accused of attempting to steal more than $1.2 million of benefits. He appeared to talk about unemployment claims in a song.

The Colorado task force will look at all kinds of possible fraud. Small cases could be referred to individual district attorneys, while the AG’s special prosecutions unit will take on more complex and multi-county cases.

Networks based outside of Colorado, or the country, will be referred to federal prosecutors through the U.S. Attorney’s Office.

Labor officials say that the state has shut down the vast majority of attempted fraud, but the state has still lost millions to scammers. They have identified about $4 million in payments to fraudulent claims, compared to $52 million worth of rejected claims.

Other states have reported far higher losses: In California, reported fraud losses total more than $11 billion.