Pueblo resident Zach Casias lives on a street with a mix of houses, including bungalows, duplexes and adobes, most with nice yards and mature trees. His home is painted yellow with brown shutters and trim and has big windows.

“I actually grew up in the house next door, which is still my father's house," Casias said. “I was the paper boy all the way through high school. So I knew the neighborhood and I know the neighbors.”

Casias bought his house 18 years ago. It’s small, just 816 square feet.

“You can tell on the inside that it used to be a one bedroom house,” he said. “It's been converted into a two bedroom house. So it's me, my wife and our son (who) live here. It's my first house. It's probably not our last.”

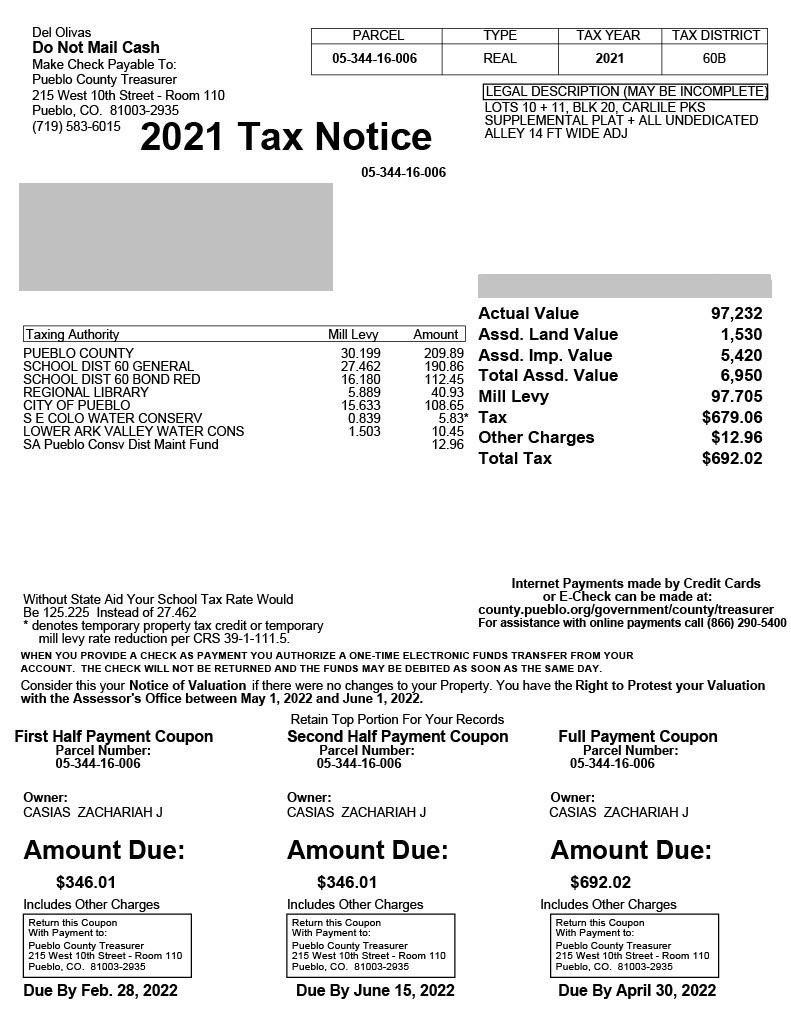

Ballooning home values during the last few years means many Colorado property tax bills are going up too, and Casias’ is no exception. But tax notices themselves are not that easy to understand.

Where does the home value come from on a tax bill?

Pueblo County Assessor Frank Beltran met Casias in front of the house. Casias asked Beltran how he assessed the value of his property.

“It goes in stages,” Beltran said. “First of all we have the whole county broken out into economic areas, from there we go down to neighborhoods.”

According to Beltran, that gives them a general framework to evaluate each home in a given area. Next they look for similarities in style, size and other characteristics, so they can group comparable properties together. For example, he said, “Is it a rancher? Is it a two-story? Is it a four-level? Does it have a basement?”

He said he also evaluates a home’s age and construction quality. “When you go up to a house, you’ve got to look at it and you’ve got to say, how was it built for the year it was built? Was it average or was it low cost or was it fair construction?”

Casias’ home is an average house for 1935 standards, according to Beltran.

Casias’ most recent tax notice says his home is valued at a little more than $97,000, an amount that will likely change next year. He asked Beltran if he could use that as an appraisal value if he wanted to sell his house.

“No," Beltran said, "because ours is always based on information from 18 months back. For this year, it's based on all of 2019 and the first half of 2020.”

Beltran said current home sales will show up in the 2023 reappraisal and with rising real estate prices, “everybody's going to go up about another 20 percent. We had some last year that went up 50 to 60 percent in some neighborhoods.”

This value that comes from Beltran's office is often referred to as base property value or market value, and as he noted, the assessment cycle lags behind the current real estate market by a couple of years.

What is “assessed value”?

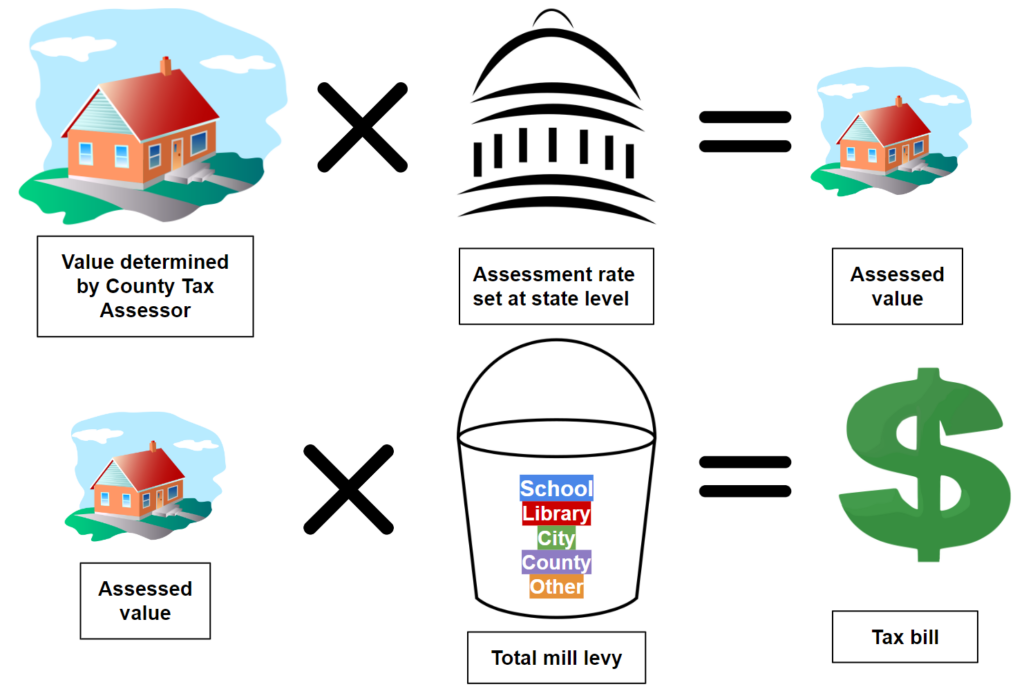

Once the assessor has determined the value of the property, it’s multiplied by what’s known as the residential assessment rate. That number is set by the state to guide how much of Colorado’s total property tax burden is paid by residential owners versus other types of properties. It’s currently 7.15.

So for Casias’ home, the value determined by the assessor is a little more than $97,000. That’s multiplied by 7.15 percent and gives what’s called an assessed value, in this case it's $6,950. That number is plugged into the tax formula, which will eventually determine how much he owes.

How the final tax bill is calculated

At the historic gold domed county courthouse, Pueblo County Treasurer Del Olivas explained what happens next to the assessed value just calculated. It involves mill levies, something voters often see on their ballots. A mill is one dollar on every thousand dollars of assessed value.

Olivas gets the assessed value from Beltran, the assessor, and then adds up various mill levies to come up with a total mill levy. On Casias’ bill, that includes the school district, library and two water conservancy districts, along with the city and county, all of which set their own mill levies annually.

“Each entity determines their own mill levy based on their approved budget,” Olivas said. The total mill levy is then applied to the assessed value to come up with the tax amount.

Step 1: Value determined by Assessor x Assessment rate = Assessed Value

Step 2: Assessed Value x Total mill levies = Tax amount

In Casias’ case his final tax amount is $692, which is likely to be a lot more next year. The treasurer’s office mails out the notices with the final tax amount, which may also include some other fees. Then the treasurer's office collects the payments and distributes the funds.

A new school: where a mill levy goes from abstract numbers to concrete walls

Centennial High School on the north side of the city is one of five aging schools Pueblo School District 60 is replacing. Construction is well underway, paid for, in part, by property taxes that homeowners like Casias vote on and pay.

“It's an awesome new educational facility,” D60 Chief Financial Officer David Horner said. “There is great daylighting. The rooms are designed for the technology that's going to be in here serving modern education going forward for the next 50 years.”

There are two different mill levies for the school district on Casias’ tax notice. He asked Horner about it.

“One of them is the general fund mill levy, which is set by the state legislature and that goes into fund general operations,” he said. “Then the state also kicks in money to fund general operations for our school district.”

“The second one is a voter approved bond mill levy and that is set each year to cover the debt for paying for all our new schools,” Horner said.

The elements of Casias’ bill are similar for homeowners around Colorado, though the amounts will vary depending on property values and the local taxing authorities. Most Coloradans are seeing increases due to rising real estate prices, and many homeowners pay their property taxes through their mortgage payment, so they’ll likely see their monthly cost go up.

Meanwhile the state legislature just passed a new bill aimed at property tax relief by reducing the residential assessment rate for the next two years.