For the first time ever, voters across Colorado will see a question about affordable housing on their ballots this November.

If the initiative succeeds, the state will dedicate some $300 million a year of existing state revenues to affordable housing, a sixfold increase from current funding levels.

The measure would not directly raise taxes. It would instead set aside a portion of existing sales tax revenues. But the measure would come with a cost to taxpayers: They would see smaller TABOR tax refunds in the future, with the housing money being taken out of the refund pool.

“We know that we've seen a huge crisis through the pandemic, but this cost of living issue is the one that is crippling Coloradans. And it is in the way of every opportunity people have,” said Mike Johnston, president and CEO of the campaign’s main backer, Gary Community Ventures.

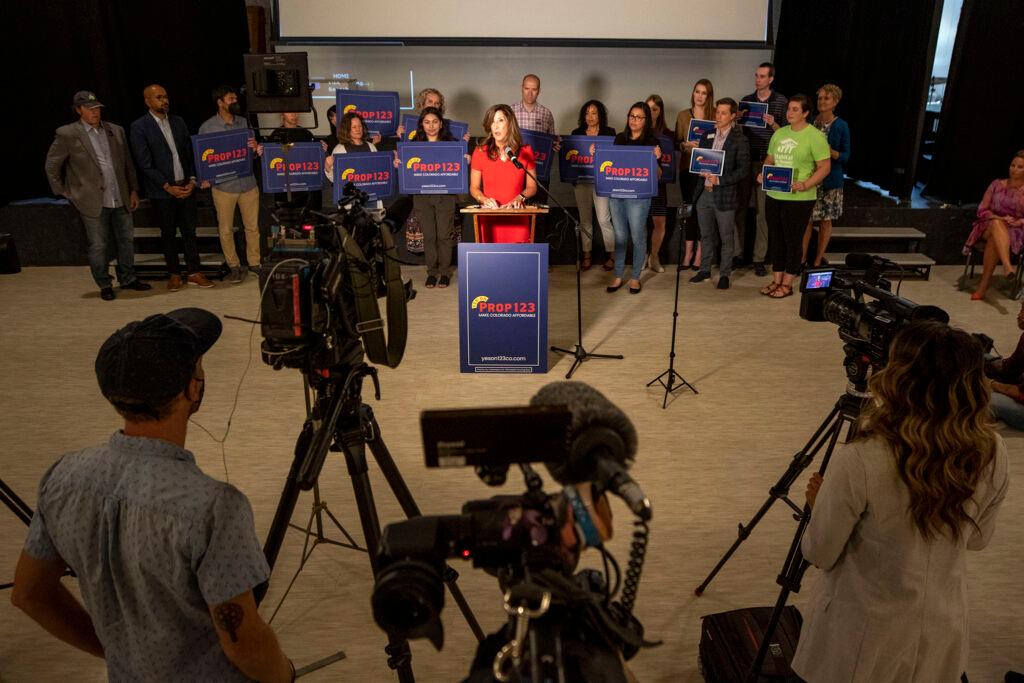

The campaign for Proposition 123 launched on Tuesday at the Village Exchange Center, a community center nestled in Aurora. Only a couple dozen people attended the midday event, but it marked the official launch of a campaign that has already raised nearly $4 million.

Sponsors said money is urgently needed due to how the pandemic amplified the state’s housing shortage. And they say it will have bipartisan appeal: 86 percent of Coloradans rated the cost of housing as a “very” or “extremely serious” problem, according to a Colorado Health Foundation poll this year.

“We have found that people across genders, different socioeconomic status, different racial backgrounds — people believe that housing is critical” said Heather Lafferty, CEO for Metro Denver Habitat for Humanity.

Proposition 123 hitting the ballot during a midterms election has benefits and risks

It’s difficult to predict the initiative’s chances this year. Running the measure in the midterms means that it could be easier to capture voters’ attention than it might be in 2024, when national politics will loom large.

But it also comes with a risk. The midterm elections are expected to draw out large numbers of conservative voters who may not support a new government spending measure.

The measure has support from more than 100 groups and people, including local Republican leaders like Jackie Millet, the mayor of Lone Tree, as well as business-oriented groups like Colorado Forum, the Colorado Association of Realtors and the Colorado Bankers Association.

But it has no public endorsements from Republican state lawmakers. And the conservative group Advance Colorado Action is opposing the measure and will “probably” spend money on ads against it, according to Michael Fields, a senior advisor for the group.

“There is nothing ‘affordable’ about taking $300 million of our TABOR tax refunds for a flawed housing measure. To fix our state’s housing crisis, we need to build more, not tax more. Coloradans are struggling, and they want their full TABOR refund in upcoming years,” he wrote in a statement.

The ballot measure could fund 10,000 units a year, but the massive housing market shortage still looms

Among Tuesday’s speakers were Jordan McDonald, a nursing assistant in Aurora who is trying to buy a home.

“Last year we were pre-approved for our home mortgage and we're basically told, try again later,” she said. “The real estate agent and lender didn't think we could afford to buy a home in this market. It's discouraging because we have no idea when later is going to be.”

Johnston estimated the measure could fund 10,000 affordable housing units per year. That’s compared to a deficit of more than 100,000 homes for the state’s poorest people — and an overall market shortage of more than 300,000 homes.

The measure will only go into effect if it’s approved by a majority of voters in the 2022 election. If so, it would create a statewide affordable housing fund for purposes including:

- Land banking. Governments and nonprofit developers would get loans to buy land for future projects. The loans are forgiven if affordable housing projects are started within a decade.

- Grants and financing for low- and middle-income multi-family housing, and gap financing for projects that qualify for affordable housing tax credits.

- Programs for people experiencing homelessness.

- Debt financing for modular and factory-based housing builders.