A core group of Democratic senators and Congress members are pushing to include an expanded Child Tax Credit in any end-of-year tax deal.

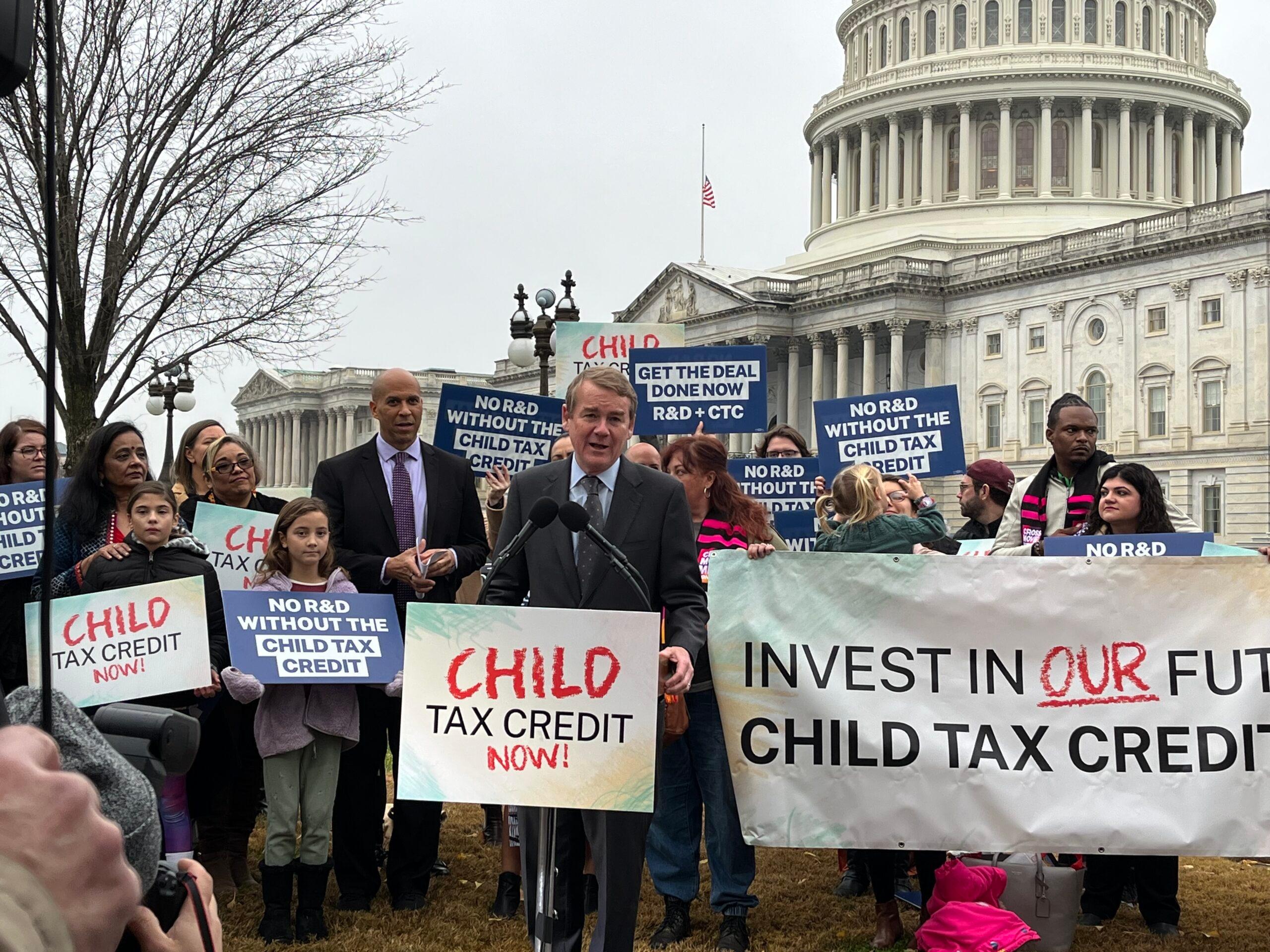

Surrounded by advocates and parents who benefitted from the expanded credit, Colorado Sen. Michael Bennet argued that at the end of the legislative year lawmakers are always working to extend tax cuts “for the wealthiest people in America, for the largest corporations in America.”

“What we’re saying this time is, before we go home, we should pass the biggest tax cut for working people in America,” he said.

Specifically, lawmakers in the group are saying they will not support a change businesses are seeking to a research and development tax credit without getting a vote on the Child Tax Credit too.

“Our task is clear,” said Connecticut Rep. Rosa DeLauro, chair of the House Appropriations Committee, at Wednesday’s event. “No R&D without CTC.”

Bennet is realistic about the challenge the idea of an expanded CTC faces, given ongoing opposition from congressional Republicans and even Democratic Sen. Joe Manchin.

So, while Bennet’s goal is to make the expanded credit permanent, “I suspect in this negotiation, we’re not going to get all the way there.”

The likelihood of a deal on either a permanent or temporary CTC expansion depends on whether Congress can come to agreement and pass an omnibus government budget bill by the end of the year. As of now, federal government funding expires Dec. 16. Congressional leaders have not decided on a topline number and there have been warnings that the government may operate on a one-year continuing resolution if a budget deal is not reached.

Bennet said he and others have had discussions with their Republican colleagues but “it’s going slowly because there’s a lot of confusion about whether or not there’s going to be an omnibus.”

He added once there is clarity on what the legislative vehicle for a deal will be, “there will be the opportunity for us to have a negotiation that won’t be complicated and that can get to a result.”

Several parents at the event talked about how the expanded credit that they received monthly during the pandemic helped with housing or child care. Lawmakers focused on how it lowered rates of childhood poverty and hunger.