When state regulators shut down Friday Health Plans this summer, it sent tens of thousands of customers scrambling for new insurance in Colorado.

The state allowed those affected to buy new plans through a special enrollment period. But not everyone did so before their Friday Health policies expired on Aug. 31.

About a quarter of the company’s Colorado customers did not choose a new plan before that deadline. As a result, about 5,000 of them will be uninsured for at least a month.

Those customers can still take action: The special enrollment period is still open, so they can choose a new plan anytime through the end of the year. In fact, about 400 people have already enrolled since the initial deadline.

“It's still not too late,” said Kevin Patterson, CEO of Connect for Health Colorado, the state’s health insurance exchange. “If they want to come in, we're still here ready to help.”

Anyone enrolling this month will begin their new coverage on Oct. 1. Those enrolling in October can begin coverage on Nov. 1. But a coverage gap of even a few weeks can be costly, since injuries and illnesses suffered during that time may not be covered by insurance.

Unexpected costs may discourage consumers

Friday Health customers in Colorado have apparently been slow to choose new health insurance, at least compared to one other state.

In North Carolina, 97 percent of the company’s customers bought a plan before their coverage expired last month, according to a state spokesman. That’s compared to about 76 percent who re-enrolled before the initial deadline in Colorado. Oklahoma and Nevada, however, are more in line with Colorado, citing respective re-enrollment rates of about 60 percent and 70 percent respectively.

Representatives of one other affected state, Georgia, wouldn’t disclose the re-enrollment rate for Friday Health customers, citing data privacy concerns.

Mike Rhoads, a deputy commissioner with the Oklahoma Insurance Department, suggested that some consumers were discouraged from switching because it can bring new costs, especially having to start over on deductibles. Switching plans also may require choosing new doctors and other hassles.

“People that have met their deductible may be rolling the dice and thinking, ‘I don’t want to go through that again.’ That is a hardship on them,” Rhoads said.

In Colorado, only two insurers — Kaiser Permanente and Denver Health Medical Plan — have offered to honor the deductibles of Friday Health plans, allowing customers to carry over progress and save money. Others have refused. Similarly, all the insurers in Oklahoma refused, Rhoads said.

Lauren Gibbs, a real estate agent in Lakewood, said she faced up to $3,000 in extra costs because of her lost deductible, and ended up cutting back on health care.

“The reason we have insurance is so we don't have an unexpected expense, like $3,000,” she said.

“Full court press” for re-enrollment

In Colorado, insurance officials reached out directly to affected customers through email and letters, and they enlisted insurance brokers and others to help spread the word, Patterson said.

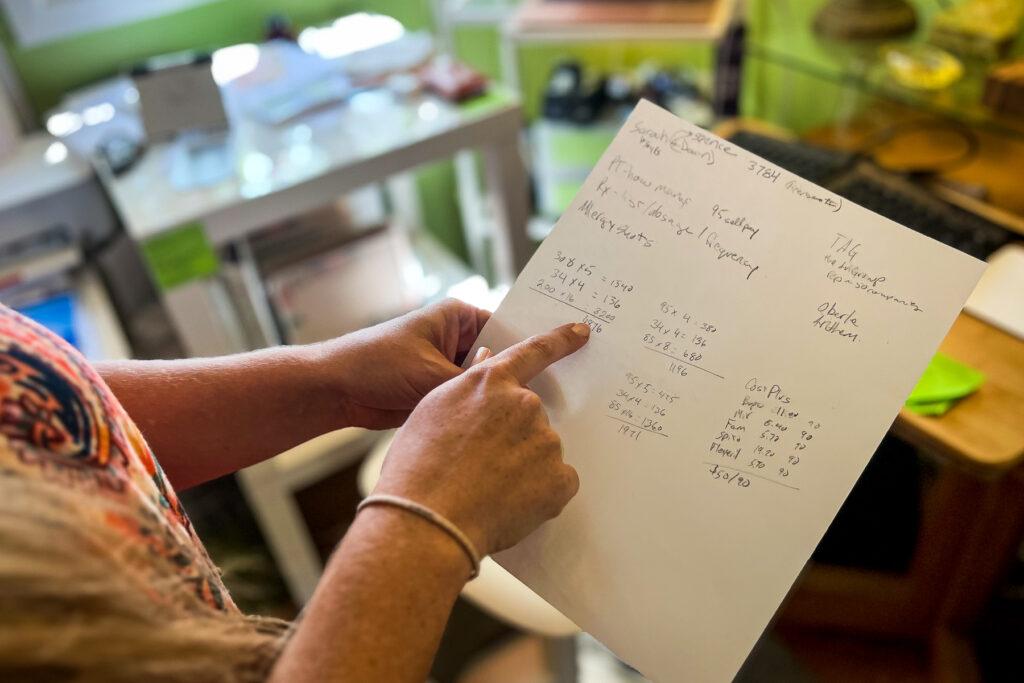

“It's just been a full-court press,” Patterson said, adding that some brokers had inquiries from hundreds of Friday Health customers. Much of the company’s marketing was focused on self-employed people and gig workers who don’t get insurance through their work.

It’s not clear why thousands of Colorado customers haven’t bought new insurance. Friday Health was one of just two insurance options for some southeast Colorado counties, according to Patterson, but he said there was no clear pattern to the enrollment lags. Demographic data on the newly uninsured wasn’t immediately available.

Colorado regulators were not alone in shutting Friday down. The company also closed up shop midyear in its four other remaining markets — North Carolina, Georgia, Nevada and Oklahoma. The company’s financial picture was worsening, and regulators feared that doctors would stop accepting Friday Health’s plans amid questions about its ability to pay.

Critics have said that Friday Health, like Bright HealthCare before it, set competitive premiums to attract customers, but ultimately grew too fast and couldn’t keep up with the costs of that coverage.

“They didn't understand health insurance. Health insurance is really complicated,” said health insurance consultant Ari Gottlieb, principal at A2 Strategy Corp and a former director for PwC's Health Services practice.

Colorado this spring placed Friday Health into receivership, essentially taking command of its state-based business amid mounting financial concerns. But soon after, in July, the company’s national leadership laid off all its staff and essentially left state regulators to handle the management and administration of the company, said state insurance commissioner Michael Conway.

“The company literally handed over the keys and said, ‘We're firing everybody as of July 6th,’” Conway said in an interview last week.

“We rehired a core base of people [from the company’s headquarters] in Alamosa. We also then worked with the contractors, the vendors … that the company hadn't been paying for quite some period of time, and we renegotiated those contracts and got those vendors back up and running,” Conway said.

Failing to do so could have resulted in “an abject disaster,” he added. “We still have bumps in the road, but it wasn't as bad as we feared that it was potentially going to be.”

Friday Health Plans and Bright HealthCare have not responded to numerous requests for comment.

Friday Health customers can still try to recover expenses

The state will continue to operate the remnants of Friday Health as its remaining claims and business affairs are settled, a process that can take years.

The shutdown may also create a financial hangover that affects other companies and customers, since they may be on the hook for costs that go beyond Friday Health’s remaining financial resources. It’s not clear yet how much money the state’s Guaranty Association — which is funded by other insurers — will have to pay toward those costs.

“We're still hopeful that it's going to be relatively small,” Conway said in the Aug. 28 interview.

There’s also the question of the costs to customers who paid thousands of dollars toward their Friday Health deductibles, only to have that progress wiped away. Those people can file claims against the estate of the company to recover some of their losses. More information is available through the state Division of Insurance.

“There will be a number of creditors that will file claims as part of the liquidation that happens in every liquidation, but there's a clear priority schedule and law too that defines who gets paid first,” Conway said. “So we're hopeful that we're going to be able to get to those policyholders that are filing claims for their deductibles or their cost shares generally. But that will run through the claims process and that should take anything around six to eight months for it to flush itself out.”

Gibbs, the real estate agent, was affected by the shutdowns of both Bright and Friday Health. She had originally hoped that the two companies would be innovators who spurred new competition in the market.

But now she’s left disappointed and hoping for bigger reforms, perhaps even including a true public option.

“Having these two collapses in a row in Colorado, the state regulators, the governor, they need to pay attention to this and understand that these are real people's lives and health on the line,” she said.