The 2023 general election will take place on Tuesday, Nov. 7. Check out CPR's voter guide here to get answers to your election questions.

Here’s the language you’ll see on your ballot:

Shall the state reduce property taxes for homes and businesses, including expanding property tax relief for seniors, and backfill counties, water districts, fire districts, ambulance and hospital districts, and other local governments and fund school districts by using a portion of the state surplus up to the proposition HH cap as defined in this measure?

How would it work?

Proposition HH would make several big changes to the finances of both Coloradans and their government. In short:

- Homeowners and other property owners get a reduction in property tax rates, which means their tax bills won’t rise as quickly even amid climbing property values

- All taxpayers would receive smaller TABOR refunds in the future, with the reduction potentially totaling $2.2 billion per year by 2033

- School budgets would be unaffected by the property tax cuts, and they might even grow substantially as a result of Prop. HH, because schools will be the primary recipients of the reallocated TABOR money

- Cities and other taxing entities would lose out on some potential property tax revenues

- The state would create a relief fund of up to $20 million per year for renters

What happens for property owners

Property tax rates would be reduced statewide. Your property taxes are determined by the following basic equation: first, the actual value of your property is multiplied by a statewide variable known as the assessment rate; the resulting “assessed value” is multiplied again by your local property tax rate, which is expressed in mills, or fractions of a cent.

Prop. HH would make changes to the statewide component of that equation so that property owners essentially pay taxes on a smaller portion of their property’s value.

The exact effect would depend on where you live, what kind of property you own and what it’s worth. But the net result would be that property owners save money, at least compared to the status quo.

For homeowners, let’s say you own a home that’s now worth $500,000, with a property tax rate of 85 mills. Your tax bill next year would be about $225 lower as a result of Prop. HH, compared to what would happen with the current rates. That’s a relative savings of about 14 percent against the status quo.

You can calculate the effects on your specific property tax bill, as well as your TABOR refund, with a tool created by state fiscal analysts. The business-oriented advocacy group Common Sense Institute also has a calculator. (The property tax results provided by the two calculators are similar, but the CSI tool attempts to project the value of TABOR refunds over a full decade — a difficult task, since refunds are dependent on short-term economic conditions.)

If you’re curious about the specifics of the change: Prop. HH would tweak a couple of statewide variables that affect your property taxes.

- The formula under current law is to take your home’s value, subtract $15,000, and then take 6.765% of what remains to get your final taxable value.

- The new Prop. HH formula would be to instead subtract $50,000 and then pay taxes on 6.7% of what remain. (That discount shrinks to $40,000 for taxes owed in 2025.)

The Prop. HH design is meant to offer a greater proportional benefit to less expensive homes. It is also targeted, in part, at owner-occupied households. Starting with taxes owed in 2026, second homes and rental properties won’t be eligible for the $40,000 valuation discount.

The relative savings offered by Prop. HH will grow in future years. That’s because, if nothing changes, some short-term property tax discounts are set to expire, driving rates higher over the next couple years. Prop. HH would instead lock in lower rates.

Overall, the change is estimated to reduce annual property tax bills by a total of more than $1 billion, compared to current law.

Local governments would have to justify increased property tax revenues. Besides the mandatory rate cuts, the measure also creates a voluntary limit that could slow down property tax growth. In years when property tax bills increase faster than general inflation, local leaders would have to decide whether they really need the extra money. If they do, they have to hold a public hearing and affirmatively vote to retain extra revenue beyond the inflation rate.

This new public process could pressure some local governments to reduce rates or send refunds in boom years. If every government were to obey the inflation-based limit, it would add another $500 million in savings for taxpayers statewide, according to fiscal analysts.

But the real number is likely to be lower since governments can just vote to keep rates the same — even if it results in political blowback.

Seniors would get a more flexible property tax break. Prop. HH would make a significant change to the Colorado’s “senior homestead” property tax exemption.

Currently, the tax benefit is offered to people at least 65 years old who have lived in the same home for 10 years or longer. It allows them to take up to $100,000 off the taxable value of their homes.

If Prop. HH passes, the benefit would become “portable” — meaning that, once you’ve secured it by living in the same place for a decade, you could then move to a new property but keep the benefit, allowing people to downsize without losing the exemption.

Changes that affect all taxpayers

TABOR refunds would be equalized in 2024. The state would once again pay “flat” refunds next year. Normally, the state gives higher refunds to those who have higher incomes and therefore paid more in taxes. The change would only happen for tax year 2023, which is refunded in 2024.

If Prop. HH fails, graduated refunds could range from about $600 to $1,800. But if it passes, all taxpayers would receive an equal refund of about $900.

Of note: State lawmakers also have the power to change the refund formula, so if Prop. HH fails, progressive Democrats may push to flatten refunds regardless.

TABOR refunds would shrink over time. Colorado pays refunds to taxpayers when its revenues grow faster than the rate allowed by the Taxpayer’s Bill of Rights. Prop. HH would raise that revenue cap, letting the state keep more money each year instead of refunding it. That money would mostly be given to schools, allowing their budgets to stay neutral or even grow despite the cuts to property taxes.

The impact of the change would increase over time. In 2023, HH would result in about $170 million of would-be refund money being used for other purposes (more on that below). But by the year 2033, Prop. HH could repurpose up to $2.2 billion per year that otherwise would have been refunded.

This means that the state economy would have to perform more strongly for taxpayers to receive TABOR refunds payments. Since all taxpayers can receive refunds, this could have fiscal implications for lots of Coloradans.

And if Prop. HH were allowed to stay in place indefinitely, the TABOR implications could get much larger. The effect on the TABOR cap and refund money could grow from $2.2 billion in tax year 2032 to nearly $6 billion in 2040, according to the Common Sense Institute.

Want to know why the TABOR effect would grow so quickly in later years? It’s all about the math behind the new formula created by Prop. HH. Currently, the TABOR cap rises at a rate determined by inflation and population growth. The new formula would be inflation, population growth — and an extra 1 percent each year. That 1 percent would compound upon itself, driving the revenue cap higher and higher each year.

The changes enacted by Prop. HH could stay in place for many years. Technically, the lower property tax rates are set to expire in tax year 2032. But the legislature could simply vote to continue the lower tax rates — and they would face significant fiscal pressure to do so.

Here’s why: By 2032, Prop. HH would have raised the TABOR cap by billions of dollars, adding significant new revenues to the state budget. But if Prop. HH were allowed to expire that year, then the TABOR cap would be lowered back down to a level determined by the current formula, and those billions of dollars would effectively disappear from the state budget. Instead, that money would once again have to be refunded to voters.

And at that point, it might be very difficult for politicians to cut the state budget by billions of dollars. So, in short: At the end of that first decade, lawmakers would be highly motivated to keep the lower property tax rates in place. But by the same token, it could be difficult to undo the changes to the TABOR cap.

Changes that affect schools, cities and others

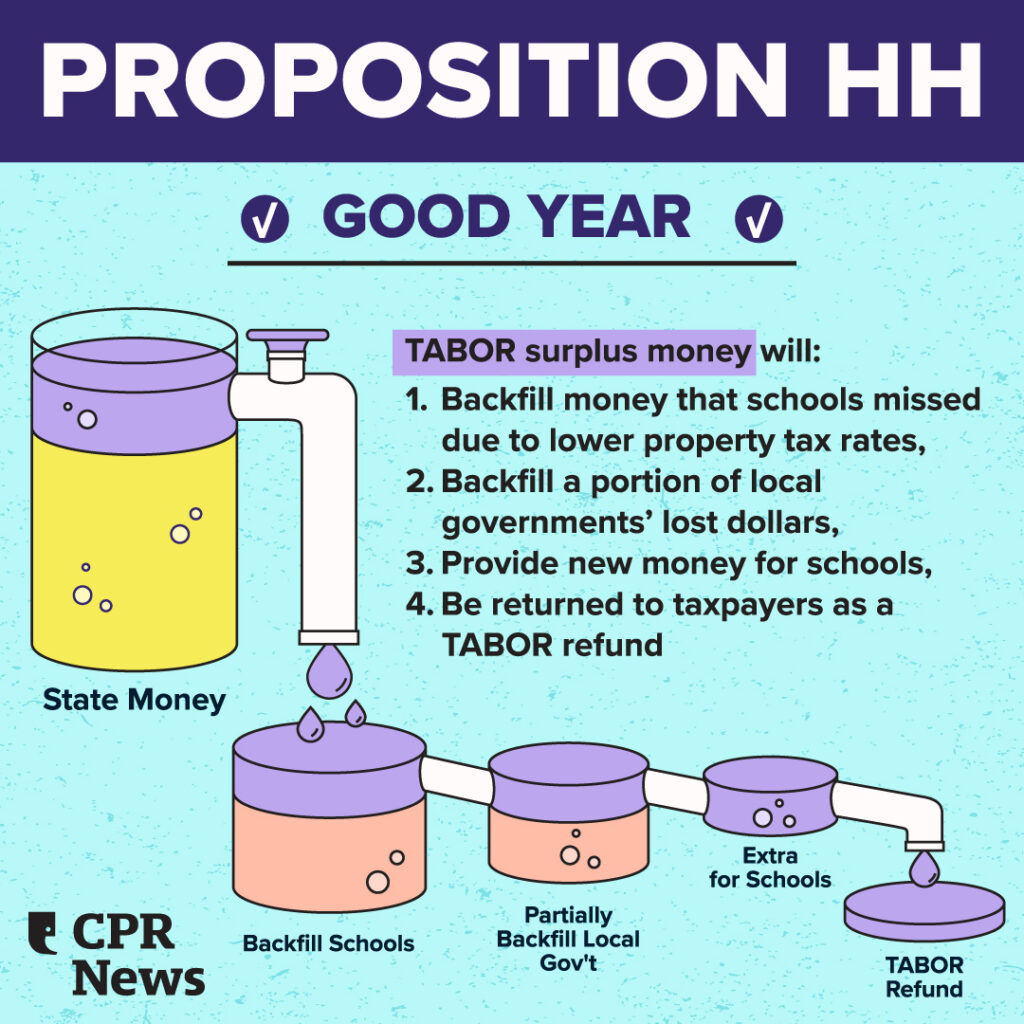

The repurposed refund money would go to backfilling lost property taxes. It would eliminate the impact of property tax cuts on schools, and it would partially reduce the effect on cities and others.

School budgets would not see any reduction, and they could benefit. Local school districts are funded in part by property taxes. So, a property tax rate cut would mean less money is available for school budgets, at least compared to the status quo.

Prop. HH would make up for that change by directing the state to provide at least an equivalent amount of state money to districts instead — which could add up to hundreds of millions of dollars.

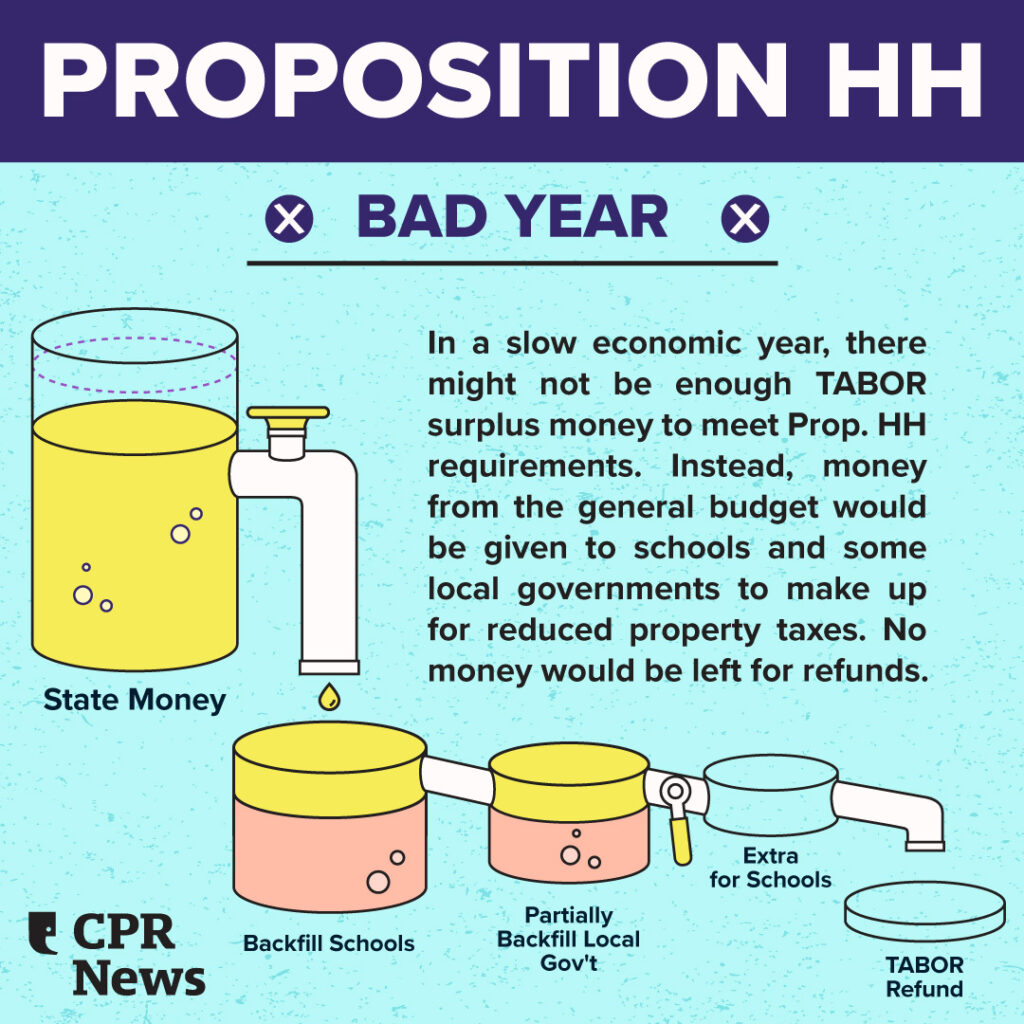

Much of that money would come from redirecting TABOR surplus/refund money, as described above. But in years where the TABOR money isn’t enough to make school districts whole, Prop. HH would require the state to dig into its general budget or spend down the state education fund to make up the difference.

If the state economy performs well enough, though, Prop. HH could actually increase overall funding for schools by hundreds of millions of dollars per year, thanks to the extra one percent that the state budget will be allowed to grow each year. Some of the lawmakers who created the measure have said this could be a way to help the state catch up to the funding targets set by voters under Amendment 23.

Cities, counties and others would still give up some money. Local governments and special districts also rely on property taxes, so their revenues will grow more slowly if rates are cut.

The Prop. HH backfill would partially make up for that change, but its impact will vary.

For some rural and slower-growing areas, the state contribution will be enough money to completely make up what they stand to lose. But larger, wealthier governments will receive only a partial backfill — perhaps only 65 percent of what Prop. HH costs them, according to fiscal analysts.

That backfill money also disappears as property values grow over time. Once a district’s total property value grows by 20 percent, compared to their 2022 levels, that district no longer gets backfill. That could happen almost immediately for some urban and resort areas, while smaller, rural areas could get backfill for close to a decade.

Unlike the rules for education funding, there is no requirement that the state use general budget money for local governments in years where there is no TABOR surplus.

Who’s for it?

Top Democrats wrote the proposal, which was put on the ballot by the legislature. Gov. Jared Polis was among the leaders behind it, and a range of Democratic lawmakers pitched in during the fast-paced negotiations.

The measure’s financial backers include a range of education, progressive and philanthropic groups, but not any tax reform groups.

The top donor as of early October was Education Reform Now Advocacy, a “dark money” group that acts as an arm of Democrats for Education Reform, which had given $300,000. Next up was Gary Advocacy, an arm of Gary Community Ventures. The group, which aims to “increase opportunity for Colorado kids and families,” has contributed $250,000. It was founded and funded by the late oilman and philanthropist Sam Gary.

The campaign also received $200,000 from the National Education Association and $60,000 from the Colorado Education Association.

Also in the mix was Pat Stryker, the billionaire who helped fund Democrats’ rise in Colorado, with $100,000, as well as a number of smaller donations from liberal and progressive organizations.

Groups endorsing HH include the AARP, the business group Colorado Concerns, a range of progressive and education organizations, the League of Women Voters of Colorado and the Colorado AFL-CIO.

Who’s against it?

The Colorado Municipal League, which represents cities and towns, is opposed. Executive Director Kevin Bommer said that local governments should be left to make decisions about local revenue. State law allows local governments to temporarily reduce local property tax rates, and some may do so this year.

Conservative groups have launched a seven-figure campaign against Prop. HH, arguing that it offers insufficient tax breaks, shrinks TABOR refunds and will eventually allow the state government budget to expand by billions of dollars. As of early September, the “No on HH” campaign has collected more than $1 million, almost entirely from the dark-money groups Advance Colorado and Defend Colorado.

Also in opposition are Colorado Counties Inc., a group representing county governments; the Special Districts Association of Colorado; the Western Colorado business group Club 20; and the Colorado Association of Realtors.

Related coverage

- Whatever happens with HH, a statewide cap on property taxes could be on next year’s ballot

- Prop. HH is supposed to be about property taxes — but it could also change the future of TABOR and schools funding

- Prop HH cleared for ballot after Colorado Supreme Court rejects a challenge

- Why Prop. HH, the Colorado property tax measure, has support from education advocates, national Democrats

- Colorado could pay equal TABOR refunds next year, but only if voters approve property tax changes

- Why are TABOR refunds so huge lately? And will they stay that way?

Funding for public media is at stake. Stand up and support what you value today.