In November of 2022, a golf charity received a $68,631 check funded by Colorado taxpayers as part of a pandemic-era program meant to attract group travel to the state with cash incentives.

The cash went to Colorado Golf Charities, a nonprofit organization that operates an annual event at Berthoud’s TPC Colorado golf course. The 18-hole course has been a stop on Korn Ferry’s professional tour since 2019.

The money trail ends there. The charity isn’t saying exactly how the money was spent. On top of that, it’s unclear how the event met the guidelines set forth by the state to qualify for the aid.

The saga of the taxpayer investment in Colorado Golf Charities is the latest example of the lack of transparency and accountability in Colorado's economic development payments to private entities promising to attract events to the state. The state program, enacted with legislation in 2021, works by giving rebates of up to 10 percent of eligible hard costs for an event, like venue rental, food, and equipment. The money is paid directly to hosts for conferences, festivals, weddings, and other types of large gatherings.

The golf tournament’s organizer, Drew Blass, said the funding gave the charity “the ability to donate funds to [other] charitable organizations.”

The nonprofit’s charitable giving that year fell short of the amount of the rebate, tax documents filed with the IRS show. In 2022, Colorado Golf Charities reported roughly $1.61 million in revenue from that year’s tournament, and $1.59 million in expenses. A little over $26,000 went to charity, mostly to the Community Foundation of Northern Colorado, tax documents show. Blass noted that the event also raised charity dollars from other organizations and provided in-kind donations like sports equipment.

Charitable donations from Korn Ferry tour events vary widely. For instance, the Albertsons Boise Open in Idaho raised $3 million for charity in 2022, while an event in Huntsville, Ala., reported $35,000 in charitable donations on tax forms.

It's unclear if Colorado Golf Charities listed the rebate on its tax documents for the year. Initially, Blass said it was reported as miscellaneous income on the form. When CPR News noted the charity hadn’t reported any miscellaneous income that year, he said it was included with reported revenue from the tournament.

The developers who built the golf course oversee the charity. They didn’t respond to CPR's requests for comment regarding the rebate.

The stated goal of Colorado’s $10 million tourism initiative, which runs through June, is to bolster group travel by providing aid to events that can prove they are in danger of being canceled or postponed due to pandemic-related costs. It also aims to bring new events to Colorado that might otherwise go to a different state.

It’s clear the golf tournament drew a crowd. More than 150 golfers descended on TPC Colorado in June 2022 for that year’s tournament. But it could not be determined whether the tournament cleared the necessary hurdles to receive government aid set forth by the state.

The tournament wasn’t in danger of being canceled. It got a financial boost that year because a new title sponsor came on board. Revenue from the tournament in 2022 shot up by more than $500,000 compared to the prior year, tax documents show.

The program guidelines say the rebate money isn’t available to recurring events that aren’t in danger of being canceled. Colorado Golf Charities didn’t purport to be in danger of cancelation on its application – which was submitted well after the event secured the big sponsorship deal. Instead, it claimed the tournament was a “brand new event” in order to qualify. That contradicts TPC Colorado’s website, which touts the numerous awards the annual tournament has won since its launch in 2019.

Blass said it qualified as “new” because a different owner took over financial responsibility for the event in 2022. It did get a new name, the Ascendant, to reflect the sponsorship deal. But whoever is footing the bill, tax documents show that the same group of developers has overseen the tournament through Colorado Golf Charities since its launch in 2019.

In an emailed statement, Colorado’s tourism office said “The application demonstrated the development of a new event.” No further explanation was provided.

Earlier reporting from CPR News found other examples of loose oversight in the program. For instance, there were seemingly no guardrails put in place to control conflicts of interest. Metropolitan State University administers the program on behalf of the state, and MSU’s largest donor was approved for a rebate of $90,000 for his daughter's wedding at Kevin Costner’s ranch in Aspen. The brother of the person who runs the program for MSU was also approved for a wedding rebate.

The tourism office won’t say whether rules have been put in place since those rebates were approved to manage potential conflicts of interest. One of the bill’s sponsors, Rep. Matt Soper, said in an email that changes had been made to the program in response to CPR News’s story, without elaborating.

The tourism office also won’t acknowledge any changes to the program to CPR News. The tourism office, as well as the state’s Office of Economic Development and International Trade, have refused repeated requests for interviews over the past 10 months.

Taxpayers still footing bills for lavish weddings

Regardless of what changes have been made to how the program is administered, records show that taxpayers continue to foot the bill for lavish weddings. Since CPR published its first story in April, the state has approved roughly $251,000 in wedding rebates for 36 events.

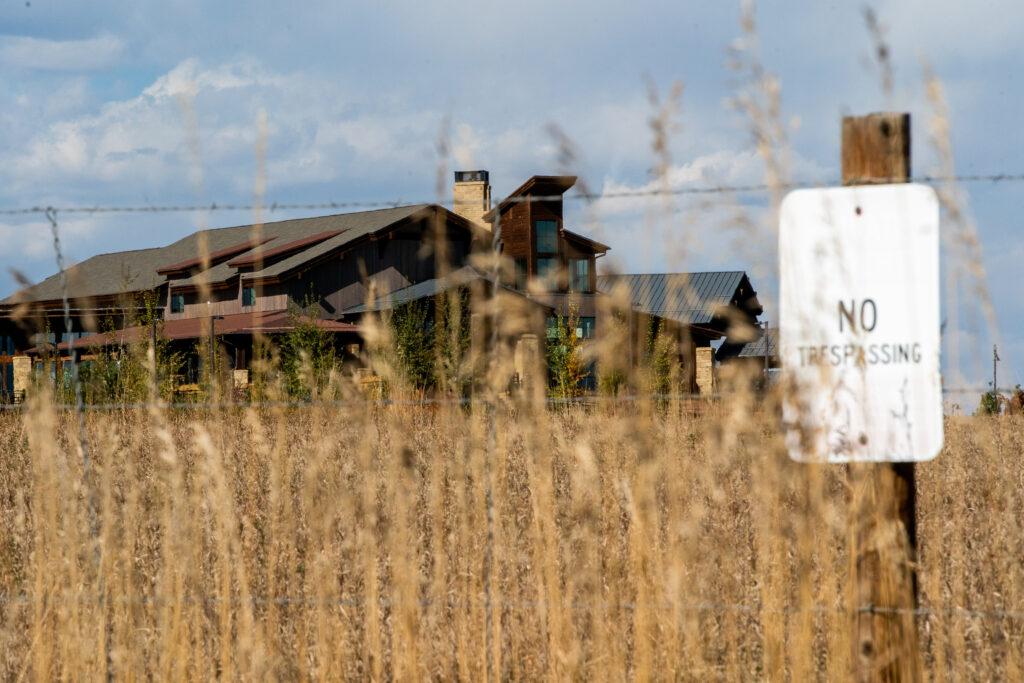

One of the recent weddings was for the daughter of real estate developer and marijuana mogul Peter Knobel. In July, Knobel hosted his daughter’s wedding at his personal ranch. Knobel, a longtime resident of Vail, is best known as the developer of Solaris, the condominium development that sits at the heart of Vail Village. In recent years, he bought a stake in Native Roots, one of Denver’s biggest cannabis dispensary chains.

Knobel’s ranch encompasses 495 acres northwest of Glenwood Springs. The wedding cost roughly $630,000, according to Knobel’s rebate application. He was approved for a $49,000 rebate to offset expenses such as $84,910 for food and $39,100 for entertainment.

Knobel didn’t respond to emails from CPR News seeking comment on the rebate.

Not everyone who applies for the rebate will get one. Dozens of people who applied for a wedding rebate were rejected.

Ashley Colon hosted roughly 220 people for her wedding at the Wellshire Event Center in Denver. By her calculation, the event fell well within the program’s parameters, which stipulate eligible hard costs of at least $35,000 and those that generate at least 25 paid overnight room nights. But the program administrator told her it some of the costs couldn't count towards a wedding.

“The reasoning was there's lot of regulations that are strict regulations for this rebate program because it's state run,” Colon said.