The smell of fresh hops permeated the air as Shawnee Adelson sat at Joyride Brewing Company in Edgewater. As Adelson set up her office for the day, workers were preparing a fresh batch of craft beer.

For Adelson, visiting breweries before they open is part of the job. She’s the president of the Colorado Brewers Guild, the trade association for Colorado’s 400-plus craft breweries. She’s been with the guild for nearly nine years, and has seen the industry grow exponentially during that time.

“We have a long history of craft beer, one of the longest histories in the U.S. and one of the largest craft beer markets in the U.S.,” she said.

That market is mighty. According to the nationwide Brewers Association, Colorado’s brewing industry consistently punches above its weight. It has the fifth most breweries per capita in the U.S. and it generates over $2.4 billion in economic impact, including jobs created and revenue generated.

While the last decade has been a high point for craft beer enthusiasts in Colorado, recent consumer trends indicate the industry may be entering a down period.

Nationwide, beer sales were down about 1 percent in 2023. In Colorado, Adelson said sales dipped by 6 percent.

That drop may sound small, but it's the worst on record since the Brewers Association started tracking industry numbers in the late 1970s. Adelson attributes the downturn to a changing consumer base.

“There's definitely more competition in the marketplace as people start drinking other types of alcohol and lean towards non-alcoholic options as well,” Adelson said. “We've seen a younger generation that is overall drinking less than older generations, so it definitely impacts obviously anybody that's in the alcohol industry.”

Since 2019, breweries have seen production costs go up substantially — not just ingredients like hops and yeast, but also packaging materials. That’s on top of labor costs, which are steadily increasing under new minimum wage laws.

“Things like malt, paperboard, cans, all of their inputs have gone up about 20 to 50 percent since 2019,” she said. “When you're thinking about when you go to a taproom and you say, ‘Oh, the beer costs a little bit more than it used to,’ these breweries are actually not raising prices as much as the prices are being raised on them. So a lot of breweries are trying to figure out how to make do with less money right now.”

Breweries are innovating to adapt

Adelson said the effects of these trends aren’t being felt equally, and businesses’ responses are not uniform. Some breweries are consolidating to cut down on overhead costs.

“You see an example of Dry Dock and Great Divide Brewing, which have merged their production facilities into one because there was excess capacity there,” she said.

Dry Dock and Great Divide still operate their own independent taprooms. But some are rejecting the concept of a physical hang-out space altogether.

Brandon Boldt co-owns Primitive Beer alongside his wife, Lisa. They closed their Longmont-based taproom and production facility at the tail end of 2023 after a nearly 7-year run.

They now operate as what they call a “nomadic” brewery, surviving through can distribution as far as China and France, as well as occasional pop-up bars at other breweries. Those limited events have been successful. Even at 3 p.m. on a random Monday, a handful of superfans came out for their pop-up event at New Image Brewery in Wheat Ridge.

“A lot of the people that are here today actually have made the trek from, we'll say, Boulder County and Longmont and all that down to Denver,” he said.

Primitive’s pop-up format means the Boldts, who have a second child on the way, can make beer without the expensive overhead of a large permanent space. And they can do it on their own terms. Before closing their Longmont location, they were teetering dangerously close to burnout.

“I can't say that we are good business people,” Boldt said. “I don't know that our decisions are necessarily going to pan out in the end, but for us, just in our basic Excel spreadsheets and all of that, this seems like the most logical choice to be able to still create what we love, but survive.”

As the industry changes, your favorite brewery’s future may be at risk

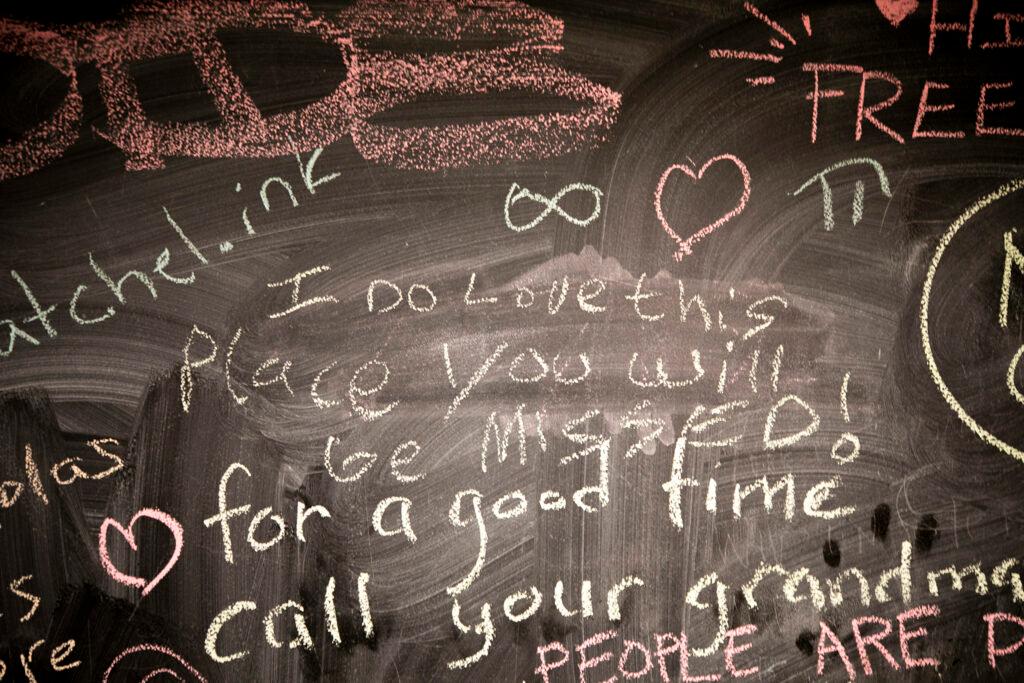

Matthew Fuerst is the owner of Grandma’s House, an eclectic brewery in Denver’s South Broadway neighborhood. He knows the reality of burnout all too well.

After over 10 years serving beer in a taproom that invited customers to play retro video games, cross-stitch and bingo nights, Fuerst is tapping out at the end of April.

“I've burnt a candle from both ends for quite some time. This is the longest job I've ever held and I haven't had much time to get away from it,” he said.

Grandma’s House is closing primarily due to issues between Fuerst and the landlord. Even so, he said he’s not sure if the brewery will ever return. If it does, it will probably look a lot different to keep up with industry trends.

“I probably want to incorporate different spirits and cider and wine and non-alcoholic beverages have been a big thing for us too, and we will continue to do that and incorporate a food element,” Fuerst said.

Adelson, the Brewer’s Guild president, says there were over 30 brewery closures statewide in 2023, and only 25 openings. But there’s still room for growth if you look outside the oversaturated Denver metro market.

“We're seeing quite a few breweries open up on the eastern plains in small towns that really just want a community gathering place, a place that somebody makes their own beer and that community can go and grab a beer and hang out with their friends,” Adelson said.

Some breweries trust that growth will continue for themselves

There are still some breweries that appear to be thriving. 4 Noses Brewing Company recently opened a large production facility and taproom in Denver’s Park Hill neighborhood after outgrowing its Broomfield location.

Dustin Ramey, the company’s marketing director, said its initial focus when it opened in 2014, was to lean into distribution into liquor and grocery stores. But, they quickly realized their Broomfield taproom was exceeding expectations.

“We pivoted a little bit more back into that taproom to really create a community environment for Broomfield and what they wanted since they clearly wanted a place to hang out and drink, let's give them what they want,” Ramey said.

Ramey acknowledged that developing a taproom culture and community at their new Park Hill location will be harder than Broomfield, given the saturated nature of the brewing industry in Denver.

But he said they know what brings people in, like weekly trivia, events, and food trucks. He said the company is confident they’re headed in the right direction.

Some brewers just try not to dwell on the trends others are feeling. Jake Gardner is the co-founder of Westbound & Down, a brewery that first started in Idaho Springs. His business sense is, if they brew it, people will come.

“I think it's like the world isn't going to quit drinking beer. I'm pretty positive of that,” he said.

Brewers said if you’re worried about what change may be around the corner, observing one of Colorado’s time-honored traditions can help — heading to the neighborhood brewery and cracking open a can or two.