When state Rep. Anthony Hartsook was a commander in the U.S. Army, he’d see soldiers try to explain why their checks bounced at the PX or Army store.

“They go, well, I have a credit card, right? I have checks in my checkbook … They just simply didn't understand.”

Hartsook would order the soldier to attend a financial literacy class.

“They would come back and go, ‘That class was great.’ They learned things they simply hadn't any experience before in life … how to deal with the expenses of living, buying a car … they understood the basics of finances that would set them up for success in the future.”

The Douglas County Republican lawmaker was surprised to learn that financial literacy is not a required course in Colorado schools. That’s when he signed on as a sponsor to a bipartisan bill to require all students to take a one-semester course in financial literacy in order to graduate.

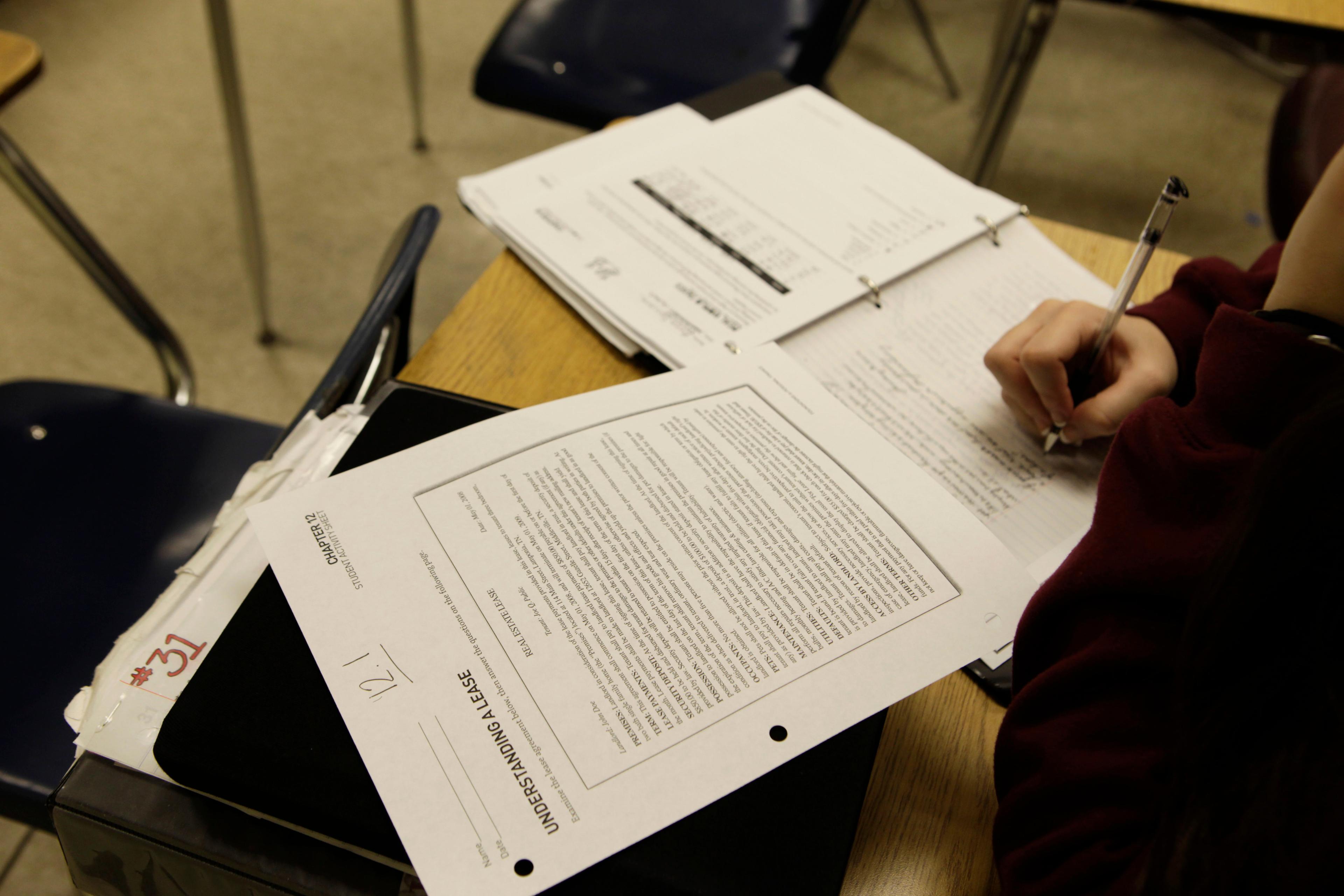

Right now, most Colorado students go out into the world with no knowledge about taxes, savings, loans or investments. Bill sponsors said just 13 percent of students are guaranteed access to a personal finance course before graduation. And today’s students are more vulnerable than ever to online gambling, cryptocurrency schemes and other get-rich-quick apps online, they say.

Colorado’s largest district, Denver Public Schools, adopted financial literacy as a graduation requirement starting with the class of 2027 after a group of DPS alumni advocated for it.

Still, just a quarter of districts require personal finance to graduate

Colorado has financial literacy standards, which were updated in 2021. They include topics like saving, investing, debt, credit, leasing versus buying, insurance premiums, managing student loan debt, and retirement plans. While the state board strongly encourages local school districts to require personal finance courses, only about a quarter of the state’s 178 districts include personal finance as a requirement to graduate.

“Encouraging just simply hasn't been getting the job done,” said Hartsook. “We have red and blue states across the country that have found this to be very successful. We need kids to graduate to enter the workforce who understand financial literacy, balance sheets, credit cards, their banks, … and just having it as a recommendation simply isn't achieving enough of what we need to do.”

The bill also makes filling out a federal or state financial aid form, the CAFSA or FAFSA, as a condition for graduation. It does, however, allow students to opt-out. Colorado ranks 46th in FAFSA completion. About 37 percent of high school seniors completed the FAFSA last year, well below the national average. State officials say Coloradans are leaving an estimated $30 million on the table in unclaimed aid each year.

“A lot of low-income families qualify for free aid, and they just don't know and they haven't filled out these forms,” said Yanely Espinal, an advocate at NGPF Mission 2030 Fund, a non-profit organization that has lobbied to get similar bills passed and other states and is affiliated with Next Gen Personal Finance. “The goal is to increase access to free aid for those who qualify and (access) to low interest rate loans so that students aren't riddled with private student debt.”

One study shows a lifetime positive benefit of $116,000 per student in Colorado when they take a semester personal finance course before graduation. Bill backers also point to other studies showing financial education’s impact on a number of factors from frequency of payday borrowing to retirement savings.

Other states

Currently, 26 states require students to take a personal finance course in order to graduate from high school. A handful of other states require financial literacy coursework to be integrated into other subjects.

Utah was the first state to adopt a financial literacy requirement during the Great Recession. A 10-year study of the effort shows, “when you get, that every single student has access to this course and they have better savings rates, they make better choices about borrowing if and when they do borrow,” said Espinal.

In particular, studies show first-generation students make much smarter decisions in terms of the interest rates they get for loans and have better credit scores in the future. They are able to compare financial services better and have money in savings accounts that yield higher rates, she said.

“That's just not true for students who don't know any better, who've never been taught that, and they don't understand the difference between those interest rates private versus federal,” said Espinal. “They don't understand unsubsidized loans versus subsidized loans, and these are all topics that are taught explicitly in a semester of personal finance.”

Hartsook said after Alabama adopted a FAFSA requirement it went from 34th to 9th in completion rates, bringing millions more in student aid to families. A Texas FAFSA requirement saw a 2 percent increase in college enrollment for schools with historically lower financial aid completion rates. Sponsors say completing aid forms also connects students to more support to learn about post-secondary and career pathways.

“When you start implementing these requirements, the kids start submitting it, families get involved, they find there's more money, and they get much further ahead in life and a better job that's going out there to contribute to society,” he said.

Bill sponsors anticipate some opposition

Colorado’s school districts control curriculum, budgets and make their own graduate requirements. Some could chafe at the requirement. The big education organizations, including Colorado’s main teacher’s union and the associations for school boards and superintendents, haven’t yet taken a position on the bill, which has the support of Gov. Jared Polis.

Bill backers note that other local control states like Michigan and Oregon have successfully passed financial literacy legislation. The bill wouldn’t increase the credits needed for graduation. Schools would have the flexibility to count the course as a math or another subject credit.

“That way each school district will have the flexibility to figure out when and where they want to put that in their curriculum. But the bottom line is, I don't know why anybody would want to object to something that is going to teach students how to handle their finances and be more successful in life.”

Espinal said there are many high-quality free financial literacy curricula available. The Colorado Department of Education maintains a financial literacy resource bank and there is free teacher training through Junior Achievement, the Council for Economic Education, and other high-quality resources from the Federal Reserve, banks and credit unions.

The bill hasn’t yet been scheduled for a hearing.